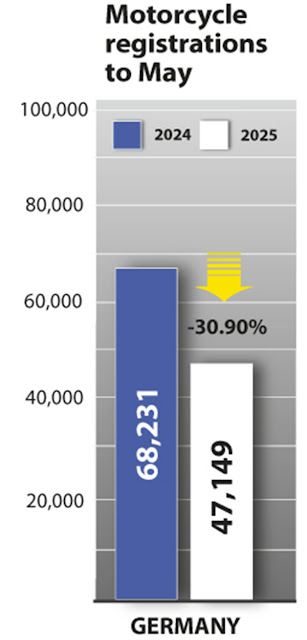

Germany motorcycle registrations to May -30.90%

For the record, registrations were recoded as -51.15% in January, -46.28% in February, -33.56% in March, -20.16% in April and -21.47% in a May.

The trend appears therefore to be headed back towards some kind of equilibrium, but being so down after three of what are generally the strongest months for new motorcycle registrations in Germany (in most markets in fact) doesn’t look good.

Though at 72,895 units (-30.76%) total PTW registrations don’t offer any clues either. There’s no apparent correlation suggesting a spending budget tightening flight to low-cost PTWs apparent in these numbers yet. So, we can’t make any kind of judgement - in either direction - about the extent to which the 21,082 motorcycle units lost in the first five months are sat within the apparent 25,793 October - December 24 Euro 5+ pre-regs compared to 2023.

The German market continues to see way more dealership closures (some retirements and bankruptcies) and P&A/G&A vendors getting into difficulties than is usual in the spring - peak time is generally in the months leading up to winter and the year end.

The list of top selling models and brand market shares remain pretty much the same compared to 2024, but on lower numbers.

The traditional top seller - the BMW R 1300 GS - remains top of the pile in Germany, followed by the Z900, CBR 650 R, Z650 and CB 750 Hornet.

With 11 models in the 50 best-selling list YTD, it’s no surprise that BMW remains top dog in its home market with a 23.51% market share (11,084 units). It was followed by Honda (20.90%/9,854 units), Kawasaki (15.29%/7,208), Triumph (7.28%/3,434) and Yamaha in fifth with a 6.75% share (3,183 units).

In Electric light motorcycles, Zero is ahead, with a 16.80% share (144 units), followed by Vmoto (6.30%/54 units), Kawasaki (4.67% share, 40 units), Bombardier (Can AM) with a 3.27% share/28 units and Harley-Davidson on a 1.87% share with just 16 of its Livewire electric motorcycle sold in the period.