Germany: motorcycles +7.35% in 2018*

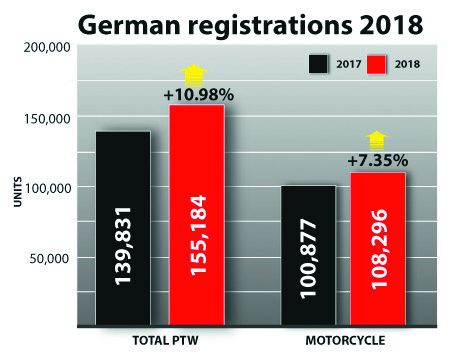

The latest data from the IVM, the motorcycle industry trade association in Germany, shows motorcycle registrations essentially flat on low volumes in December 2018 at -0.30 percent (2,000 units), having been +1.54 percent (2,566 units) in November. Registrations for the full year 2018 were said to be +7.35 percent (108,296 units).

In total PTW terms, December was -8.90 percent (3,133 units), having been +9.49 percent in November (4,444 units) and +22.17 percent (7,809 units) in October. Total PTW registrations for the full year 2018 in Germany were 155,184 units, which is put at +10.98 percent.

If true, that would be the second best annual figure for the German market since before 2008 (2016 saw a claimed 172,846 units registered), precisely because of the Euro 3 inventory pre-registrations processed by manufacturers and their dealers.

The top selling model in 2018 was the BMW R 1200 GS (7,304 units), followed by the Yamaha MT-07 (3,199), the Kawasaki Z900 (3,091) and Z 650 (2,787), with the Honda CRF 1000 ‘Africa Twin’ (2,392 units) fifth.

With five models in the Top 20 best sellers, BMW remains motorcycle market leader, though with a reduced share (-7.00%) of 21.25 percent (23,017 units). Kawasaki was fifth with a 11.96 percent market share (12,995 units, +25.11%); Honda third with a 11.82 percent share (12,802 units, +1.18%); KTM fourth with a 11.07 percent share (11,993 units, +24.82%) and Yamaha fifth with a 10.22 percent share (11,063 units, +1.74%).

In percentage terms, the biggest market sector in Germany is the sportsbike market (28.38 percent of all sales/30,732 units), and the fastest growing sectors, in percentage growth terms, are the Supersports (+18.16 percent at 4.46 percent of all sales/4,834 units) and the custom market (“chopper”), which is up by +17.24 percent (10.49 percent of all sales/11,355 units). The second largest sector in overall terms are what are termed “classical” models (naked bikes etc), which account for 27.82 percent of sales (30, 124 units/+13.49%).

All sectors of the German market are up except for the Tourer and Luxury Tourer market (4.67 percent share, 5,053 units, -10.38%). The Enduro market was worth 25,209 units in 2018, making it Germany’s third largest sector with a 23.28 percent share (+6.07%).

*As with other of Europe’s markets, while the unit numbers make good reading, some caution needs to be used when judging the apparent year-on-year percentage market growth because of the several thousands of pre-registered Euro 3 models registered in late 2016 that were actually sold ‘as new’ by dealers in early 2017, meaning that the real numbers for 2017 were higher than officially recorded.