European Parliament tells EU Commission that future transport policies and regulations must "stimulate and facilitate the use" of PTWs

On September 10th 2015 the European Parliament adopted Wim van de Camp’s "Report on the implementation of the 2011 White Paper on Transport: taking stock and the way forward towards sustainable mobility".

In the report motorcycles are seen as a way to "solve the problems in urban transport by tackling congestion and parking problems" as well as providing a solution for "small logistics". The report also states that the specific design and arising benefits of these vehicles should be "adequately taken into account and reflected in EU transport legislation and guidelines".

In Mr Van de Camp’s report the implementation of the White Paper on Transport (launched by the European Commission in 2011) is evaluated with recommendations given for the next years.

Although this report has no legislative characteristics itself, it will be a reference on which "many regulations in the wide area of transport" will be based on a moving forward basis. In it motorcycles are clearly identified as having a valuable transport policy contribution to make.

This means that using motorcycles should be "stimulated and facilitated". Also that motorcycles and other powered two-wheelers should be considered when new roads are designed and existing ones maintained or redesigned.

The European Parliament also calls for actions to reduce accidents among vulnerable road users, in particular users of two-wheeled vehicles, pedestrians in urban environments and older drivers. It also calls for better design and better maintenance of all roads in the whole of Europe.

FEMA’s General Secretary Dolf Willigers said: "This is the first time that the European Parliament [officially and formally] recognizes the importance of motorcycles for transport. We have been saying for a long time that motorcycles are part of the solution for urban congestion, environment and parking problems.

"The use of motorcycles should be stimulated and facilitated. In cities like Rome and Paris there would be enormous problems if anybody who now uses a motorcycle or scooter would go by public transport or, even worse, by car. Therefore we are very glad with the report from Wim van de Camp and its adoption by the European Parliament.

"We hope that the European Commission will do something with it and take adequate action".

The full text of the "Report on the implementation of the 2011 White Paper on Transport: taking stock and the way forward towards sustainable mobility" can be found here.

www.fema-online.eu

Thursday, 24 September 2015

German motorcycle registrations

German motorcycle registrations +6.77 percent for first eight months

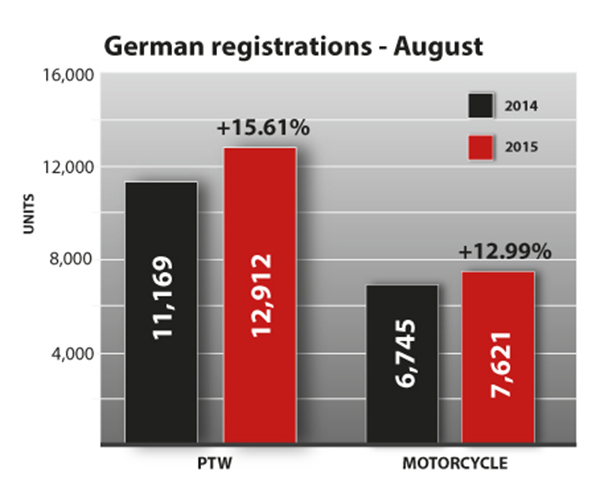

The latest data released by the German motorcycle industry trade association (IVM) shows new motorcycle registrations up by +12.99 percent (7,621 units) for August 2015 and +6.77 percent (88,047 units) for the year-to-date.

That was the best August market performance in Germany, in new motorcycle registration terms, since 2012 and the best for the first eight months of the year for a decade, confirming the return to pre-recessionary levels in Germany reported in the last edition of International Dealer News.

In total PTW terms August was +15.61 percent in Germany (12,912 units - the best August market performance for at least 10 years), and the market is +7.28 percent (126,307 units), also the best performance for the first 8 months of the year for a decade or more.

Motorcycle registrations in Germany in July were +13.66 percent (12,912 units); total PTW registrations +15.27 percent (17,329 units).

The latest data released by the German motorcycle industry trade association (IVM) shows new motorcycle registrations up by +12.99 percent (7,621 units) for August 2015 and +6.77 percent (88,047 units) for the year-to-date.

That was the best August market performance in Germany, in new motorcycle registration terms, since 2012 and the best for the first eight months of the year for a decade, confirming the return to pre-recessionary levels in Germany reported in the last edition of International Dealer News.

In total PTW terms August was +15.61 percent in Germany (12,912 units - the best August market performance for at least 10 years), and the market is +7.28 percent (126,307 units), also the best performance for the first 8 months of the year for a decade or more.

Motorcycle registrations in Germany in July were +13.66 percent (12,912 units); total PTW registrations +15.27 percent (17,329 units).

UK motorcycle market

UK market +15.85 percent for the eight months to August

The latest data from the motorcycle industry trade association in the UK (MCIA) shows August new motorcycle registrations up by +18.17 percent (7,135 units - the best August figure for more than 10 years) and for the year-to-date up by +15.85 percent (74,113 units - also the best first eight month UK market performance for a decade).

In total PTW terms the UK market is also convincingly now back to pre-recessionary levels with August +13.91 percent (7,951 units) and the year-to-date +13.17 percent (80,189 units).

Scooter style mopeds and other small cc units are -11.8 percent for the year-to-date at 6,076 units.

The fastest growing sector of the UK market in styling terms this year has been 'Naked' bikes, +30.4 percent at 21,783 units; with Adventure Sport models showing +24.3 percent growth (11,960 units). Trail/Enduro models are + 12.2 percent (3,652 units YTD), Supersport models are + 12.1 percent YTD (9,867 units), custom style machines are +11.5 percent (6,599 units), but in a market realignment trend being seen elsewhere in Europe, Sport/Touring machines are -5.1 percent for the YTD in the UK with traditional Touring models -12.9 percent.

Machines between 651 and 1,000cc are +27.2 percent YTD (18,732 units), and 14,822 units over 1,000 cc were sold in the first eight months of the year (14,882 units). The biggest market sector is the 51 - 125 cc band, which is +14.3 percent YTD at 29,087 units out of the 80,189 total.

Honda has the #1 market share in the UK (1,228 units) with Yamaha second (1,030 units), and Lexmoto third (644 units) followed by Suzuki, Triumph, Kawasaki, Piaggio, BMW, Harley-Davidson and KTM 10th.

The latest data from the motorcycle industry trade association in the UK (MCIA) shows August new motorcycle registrations up by +18.17 percent (7,135 units - the best August figure for more than 10 years) and for the year-to-date up by +15.85 percent (74,113 units - also the best first eight month UK market performance for a decade).

In total PTW terms the UK market is also convincingly now back to pre-recessionary levels with August +13.91 percent (7,951 units) and the year-to-date +13.17 percent (80,189 units).

Scooter style mopeds and other small cc units are -11.8 percent for the year-to-date at 6,076 units.

The fastest growing sector of the UK market in styling terms this year has been 'Naked' bikes, +30.4 percent at 21,783 units; with Adventure Sport models showing +24.3 percent growth (11,960 units). Trail/Enduro models are + 12.2 percent (3,652 units YTD), Supersport models are + 12.1 percent YTD (9,867 units), custom style machines are +11.5 percent (6,599 units), but in a market realignment trend being seen elsewhere in Europe, Sport/Touring machines are -5.1 percent for the YTD in the UK with traditional Touring models -12.9 percent.

Machines between 651 and 1,000cc are +27.2 percent YTD (18,732 units), and 14,822 units over 1,000 cc were sold in the first eight months of the year (14,882 units). The biggest market sector is the 51 - 125 cc band, which is +14.3 percent YTD at 29,087 units out of the 80,189 total.

Honda has the #1 market share in the UK (1,228 units) with Yamaha second (1,030 units), and Lexmoto third (644 units) followed by Suzuki, Triumph, Kawasaki, Piaggio, BMW, Harley-Davidson and KTM 10th.

Barracuda

Italian designed Scrambler accessories

ITALIAN parts and accessory specialist Barracuda is the latest designer to offer upgrades for the Ducati Scrambler.

Barracuda offer a wide range of universal fit accessories, such as these handlebar levers, as well as model-specific components, and for the Ducati Scrambler these include a number/license plate kit, rear fender and windshield as seen here.

Founded in 2002 by Alessandro Giardina, Barracuda is essentially a design company, shipping products for most popular makes and models worldwide from its 1,000 sqm facility in Florence, Italy.

Manufacturing is at selected partner factories in Italy and Taiwan - factories where OE parts and components are already made, guaranteeing the quality that Giardina insists on for the Barracuda brand. He says that at least fifty percent of the Barracuda line is made in Italy, but that 100 percent of the designs are pure Italian from their Florence studios.

"All our designs are protected, with registered E-marks, and we work on the basis of delivering stylishly enhanced, ergonomically well thought-out and precision-manufactured parts solutions in the highest quality materials for the application.

"We aim to operate at the top-end of the market with many new concepts. Our 'YOUDesign" programme is one where the buyer is able to customise the finished look with different insert colours and other optional details. Our ALUX project is aimed at delivering the absolutely best available quality right at the very top-end of the parts and components market. Our "SKIN" concept is a project that delivers the most essential design elements of a part, with top design features and improvements in style and function terms, but at a price that is very competitive with the kind of poorer designed mass produced items that have ruined dealer margins and rider expectations".

BARRACUDA SRL UNIPERS

www.barracudamoto.com

ITALIAN parts and accessory specialist Barracuda is the latest designer to offer upgrades for the Ducati Scrambler.

Barracuda offer a wide range of universal fit accessories, such as these handlebar levers, as well as model-specific components, and for the Ducati Scrambler these include a number/license plate kit, rear fender and windshield as seen here.

Founded in 2002 by Alessandro Giardina, Barracuda is essentially a design company, shipping products for most popular makes and models worldwide from its 1,000 sqm facility in Florence, Italy.

Manufacturing is at selected partner factories in Italy and Taiwan - factories where OE parts and components are already made, guaranteeing the quality that Giardina insists on for the Barracuda brand. He says that at least fifty percent of the Barracuda line is made in Italy, but that 100 percent of the designs are pure Italian from their Florence studios.

"All our designs are protected, with registered E-marks, and we work on the basis of delivering stylishly enhanced, ergonomically well thought-out and precision-manufactured parts solutions in the highest quality materials for the application.

"We aim to operate at the top-end of the market with many new concepts. Our 'YOUDesign" programme is one where the buyer is able to customise the finished look with different insert colours and other optional details. Our ALUX project is aimed at delivering the absolutely best available quality right at the very top-end of the parts and components market. Our "SKIN" concept is a project that delivers the most essential design elements of a part, with top design features and improvements in style and function terms, but at a price that is very competitive with the kind of poorer designed mass produced items that have ruined dealer margins and rider expectations".

BARRACUDA SRL UNIPERS

www.barracudamoto.com

Draggin Jeans

CE hoody

CE hoodyDraggin Jeans has expanded its range of protective clothing to include a hooded sweatshirt. The new Roo Hoody has CE armour and is lined with Roomoto (Draggin’s own abrasion-resistant fabric), in key areas on the inside.

Constructed using DuPont Kevlar, Roomoto is said to be proven to be highly abrasion resistant, yet soft, breathable, flexible and non-allergenic. In addition, the Roo Hoody also features Draggin's removable ‘Dffuse’ CE-approved armour at the elbows, shoulders and back.

Features also include an adjustable and removable hood and glove-friendly thumb holes in the cuffs.

DRAGGIN JEANS PTY LTD

www.dragginjeans.net

Gilles Tooling

Trackday footpegs

Gilles Tooling has worked with Keith Code's California Superbike School to produce a new design of sportbike trackday-friendly footpegs.

The patented design includes sloped ends to allow the rider more comfort while hanging off the bike and a wide and rounded top surface to offer a large contact area and the best possible grip.

The mounting system used for the pegs allows for rotation around 15 steps for exact rider alignment. The new pegs have been designed to work with Gilles Tooling’s turning joints and fit on stock rearsets on approximately 250 different motorcycle models.

GILLES TOOLING GMBH

www.gillestooling.com

Gilles Tooling has worked with Keith Code's California Superbike School to produce a new design of sportbike trackday-friendly footpegs.

The patented design includes sloped ends to allow the rider more comfort while hanging off the bike and a wide and rounded top surface to offer a large contact area and the best possible grip.

The mounting system used for the pegs allows for rotation around 15 steps for exact rider alignment. The new pegs have been designed to work with Gilles Tooling’s turning joints and fit on stock rearsets on approximately 250 different motorcycle models.

GILLES TOOLING GMBH

www.gillestooling.com

K&N Engineering

Intake system for Yamaha VXS950 Bolt

K&N offers stock replacement and high-performance custom open element air cleaner assemblies for the 2014 Yamaha Star XVS950 and XVS950R.

The custom air cleaner unit includes a solid mounted backing plate, with integrated velocity stacks and an improved air flow and custom oversized K&N performance air filter specifically designed to fit the Bolt intake. The kit also has a black powder coated billet aluminium top plate that features CNC machined contrast-cut reliefs.

K&N’s air cleaner is said to be dyno proven to increase horsepower and torque on an otherwise stock ‘14 Yamaha Bolt XVS950, with tests showing an additional 7.14 horsepower at 5,313rpm and 4.81lb-ft of torque at 4,581rpm.

K&N ENGINEERING/SRM EUROPE BV

www.knfilters.com

K&N offers stock replacement and high-performance custom open element air cleaner assemblies for the 2014 Yamaha Star XVS950 and XVS950R.

The custom air cleaner unit includes a solid mounted backing plate, with integrated velocity stacks and an improved air flow and custom oversized K&N performance air filter specifically designed to fit the Bolt intake. The kit also has a black powder coated billet aluminium top plate that features CNC machined contrast-cut reliefs.

K&N’s air cleaner is said to be dyno proven to increase horsepower and torque on an otherwise stock ‘14 Yamaha Bolt XVS950, with tests showing an additional 7.14 horsepower at 5,313rpm and 4.81lb-ft of torque at 4,581rpm.

K&N ENGINEERING/SRM EUROPE BV

www.knfilters.com

MIVV

Titanium silencer

MIVV is now offering a titanium exhaust for both air- and liquid-cooled BMW R 1200GS models with the MIVV is offering a titanium exhaust for both air- and liquid-cooled BMW R 1200GS models with the introduction of its Gs Titanium Edition.

Based upon the design of the existing stainless steel Speed Edge silencer, the Gs Titanium Edition has a claimed weight of just 2.4kg. Included with the version for the ’13-’15 1200GS is a carbon fibre heat shield.

MIVV SPA

www.mivv.it

MIVV is now offering a titanium exhaust for both air- and liquid-cooled BMW R 1200GS models with the MIVV is offering a titanium exhaust for both air- and liquid-cooled BMW R 1200GS models with the introduction of its Gs Titanium Edition.

Based upon the design of the existing stainless steel Speed Edge silencer, the Gs Titanium Edition has a claimed weight of just 2.4kg. Included with the version for the ’13-’15 1200GS is a carbon fibre heat shield.

MIVV SPA

www.mivv.it

Polini

Polini 50 & 125cc street and race performance upgrades

ITALIAN specialist Polini continues to improve the line-up of small cc performance race and street options available for dealers.

Their new Evolution 2 kit for the 125cc Vespa Primavera ET3 for track use by those running in the 135cc Vespa category features cylinders that work in the original and developed muffler-friendly turned orientation favoured by many in race applications.

Featuring rotary valve induction, the kit can be fitted to all 125cc Vespa models using a crankshaft with OE measurements or the Polini balanced solid-block milled con-rod crankshaft with the original 51mm stroke.

The Nickel-Siliceous coated lined cast aluminium cylinder has a 58mm bore for a 135cc displacement. There are 6 race-style transfer ports, two chromed cast iron piston rings for the gravity, cast light alloy piston and a cooling-finned one-piece cast aluminium cylinder head.

Polini's award-winning Maxi Hi Speed Variator is now available in a version for the Honda Forza 125 that can be adapted for SH 125-150 applications which features many new design improvements.

Among them are a new polishing treatment to further reduce roller sliding surface friction; a case-hardened chromed nickel-steel tempered and ground bush and a large internal grease reservoir with springed-pin distribution. A compression spring is available that is said to be 10 percent less hard than the OE item for increased starting rpms.

Polini say that these changes produce reliable, constant and consistent performance without engine efficiency roller calibration and reduce service costs and improve durability.

Also seen here Polini's CP carburettors for Vespa 50cc 16.16 manifold rigid connection, which are 100 percent made in Italy, being designed, developed and produced by the company at its Bergamo factory.

Using a clamp, they are supplied with air-box with upgraded 17.5 mm diameter intake and a short inlet pipe with an exclusive concentric design and a geometry that is said to optimise air flow.

POLINI MOTORI SPA

www.polini.com

ITALIAN specialist Polini continues to improve the line-up of small cc performance race and street options available for dealers.

Their new Evolution 2 kit for the 125cc Vespa Primavera ET3 for track use by those running in the 135cc Vespa category features cylinders that work in the original and developed muffler-friendly turned orientation favoured by many in race applications.

Featuring rotary valve induction, the kit can be fitted to all 125cc Vespa models using a crankshaft with OE measurements or the Polini balanced solid-block milled con-rod crankshaft with the original 51mm stroke.

The Nickel-Siliceous coated lined cast aluminium cylinder has a 58mm bore for a 135cc displacement. There are 6 race-style transfer ports, two chromed cast iron piston rings for the gravity, cast light alloy piston and a cooling-finned one-piece cast aluminium cylinder head.

|

| Polini's Maxi Hi Speed Variator for Honda Forza 125s features many design and performance refinements that reduce service costs and improve durability; can be adapted for SH 125-150 applications |

Polini's award-winning Maxi Hi Speed Variator is now available in a version for the Honda Forza 125 that can be adapted for SH 125-150 applications which features many new design improvements.

Among them are a new polishing treatment to further reduce roller sliding surface friction; a case-hardened chromed nickel-steel tempered and ground bush and a large internal grease reservoir with springed-pin distribution. A compression spring is available that is said to be 10 percent less hard than the OE item for increased starting rpms.

Polini say that these changes produce reliable, constant and consistent performance without engine efficiency roller calibration and reduce service costs and improve durability.

|

| CP carburettor of Vespa 50 rigid connection, supplied with air-box with upgraded intake |

Also seen here Polini's CP carburettors for Vespa 50cc 16.16 manifold rigid connection, which are 100 percent made in Italy, being designed, developed and produced by the company at its Bergamo factory.

Using a clamp, they are supplied with air-box with upgraded 17.5 mm diameter intake and a short inlet pipe with an exclusive concentric design and a geometry that is said to optimise air flow.

POLINI MOTORI SPA

www.polini.com

Rukka

AquaAir and AiRider

THE AiRider suit from Rukka is made from soft, air-permeable Cordura AFT knitware - the wide mesh of the weave allows air circulation and breathability.

Highly abrasion resistant Cordura AFT elbow reinforcements and CE-certified progressive impact energy absorbing Rukka D3O Air joint protectors are said to provide passive safety and a rear sleeve mean the jacket can be upgraded with an optional back protector.

Additional features include magnet collar closure, upper arm fit adjustment and pockets/storage space.

AiRider trousers are cut in a casual five-pocket denim style with Keprotec Antiglide trim at the seat; inside the Rukka AirCushion system is said to provide efficient climate management; an all-round waist zipper matches the trousers to the AiRider jacket.

Rukka say that their AquaAir overall, also seen here and available in black or blue, is the first one-piece Gore-Tex suit the company has made - a Gore-Tex membrane provides breathable weather protection. Additional features include pre-shaped sleeves and legs, a high collar in elastic Gore-Tex, adjustable belt and Keprotec Antiglide trim at the seat.

RUKKA/L-FASHION GROUP

www.rukka.com

THE AiRider suit from Rukka is made from soft, air-permeable Cordura AFT knitware - the wide mesh of the weave allows air circulation and breathability.

Highly abrasion resistant Cordura AFT elbow reinforcements and CE-certified progressive impact energy absorbing Rukka D3O Air joint protectors are said to provide passive safety and a rear sleeve mean the jacket can be upgraded with an optional back protector.

Additional features include magnet collar closure, upper arm fit adjustment and pockets/storage space.

AiRider trousers are cut in a casual five-pocket denim style with Keprotec Antiglide trim at the seat; inside the Rukka AirCushion system is said to provide efficient climate management; an all-round waist zipper matches the trousers to the AiRider jacket.

Rukka say that their AquaAir overall, also seen here and available in black or blue, is the first one-piece Gore-Tex suit the company has made - a Gore-Tex membrane provides breathable weather protection. Additional features include pre-shaped sleeves and legs, a high collar in elastic Gore-Tex, adjustable belt and Keprotec Antiglide trim at the seat.

RUKKA/L-FASHION GROUP

www.rukka.com

Thursday, 17 September 2015

American International Motorcycle Expo

Motorcycle Industry Association in United States buys Orlando, Florida based American International Motorcycle Expo

Motorcycle Industry Association in United States buys Orlando, Florida based American International Motorcycle ExpoThe Motorcycle Industry Council (MIC) in the United States has announced that it has acquired the American International Motorcycle Expo (AIMExpo - Orlando, Florida, October 15th - 18th) from founder Marketplace Events (MPE).

Larry Little, former President of MPE's Motorcycle Group and a prior Chairman of the MIC Board of Directors, said that: "Your industry’s trade association and the industry’s most important trade show have joined forces to help advance our business environment and allow the motorcycle industry to sustainably expand the riding community across generations."

As a part of MIC, AIMExpo becomes an extension of the MIC’s "mission of preserving, protecting and promoting the motorcycle and powersports industry that we are a part of. We’ll be developing incentives for MIC member companies for the 2016 show, which will be announced in early 2016.

"For AIMExpo dealer attendees, we’ll have a greater opportunity to showcase the value of dealer membership including MIC’s continual presence on Capitol Hill where the mission to protect our industry is ongoing.

"To answer the questions that will arise about the immediate impact of this move on this year’s show, the simple answer is - there will be no impact. It is business as usual, with the same AIMExpo team producing the same show with the same high level of customer service that we've already become known for."

The show now becomes part of a new department titled ‘MIC Events’. The physical move to MIC offices in Irvine, California, will occur following this year’s show. All AIMExpo personnel, including V-Twin Director Bob Kay, remain in-post. Next year’s show - AIMExpo 2016 - is still scheduled for October and will remain in Orlando.

The MIC is quoted as saying that "owning our industry’s biggest and most popular trade show fits perfectly within MIC’s mission. Trade shows intrinsically represent exhibitors (i.e., MIC Member Companies), facilitate communications among exhibitors, and help promote the goods and services offered by exhibitors to {dealers and] the public - all [of which are] normal day-to-day operations for the MIC.

"MIC was able to purchase the Expo without affecting membership dues. MIC’s ownership of a platform such as AIMExpo can help advance our business environment and allow the motorcycle industry to sustainably expand the riding community across generations.

"For some time, the MIC Board of Directors has discussed owning powersports events, but did not proactively pursue the idea. However, when Marketplace Events approached MIC about selling its Motorcycle Group, the Board took action. After extensive discussion and due diligence, the board was unanimous in its decision to move forward with the purchase.

"Larry Little, one of the founders of AIMExpo while a Director on the MIC Board, recused himself from all acquisition discussions and activities. As an MIC employee, Larry is ineligible to serve on the board and has resigned his board position. The open board position will be filled in the upcoming annual board election.

"AIMExpo entered the motorcycle event scene in 2013 and made an immediate impact. Its early success and high level of industry adoption has been unparalleled. The MIC is proud to be associated with AIMExpo, and your industry association stands better equipped than ever to preserve, protect and promote motorcycling."

This news brings closure to a sequence of events that has not always worked to the benefit of the motorcycle industry, one that actually goes back some 30 years. When Advanstar acquired what eventually became the 'Dealer Expo' that was staged at Cincinnati, then Indianapolis, then finally and for one year only at Chicago in December last year, it had been mooted that the MIC was itself eying launch of its own industry expo.

To head-off competition from the industry's trade association, Advanstar struck a sweatheart deal with the MIC that saw members score discounts, and a percentage of show income going into the trade association's coffers.

When the V-Twin industry was under pressure from impending increases in the regulatory obstacles that motorcycle modification faced ten years ago, especially where aftermarket performance components and engines were concerned, this was an arrangement that backfired on both the MIC and the v-twin industry.

Endeavouring to create a forum for the sector through its then new V-Twin Committee, the MIC fell foul of restrictions that its deal with Advanstar placed on it in terms of being able to stage meetings for the sector at the rival V-Twin Expo at Cincinnati.

Now, however, all is changed. In addition to having severed its ties with 'Dealer Expo', the MIC changed its membership profile three or four years ago to start offering a dealer-membership program.

With it now itself taking ownership of the premier 'mainstream' motorcycle industry trade expo in America, maybe the way will be clear in the future for the MIC to be able to build bridges with the v-twin industry and finally start developing the kind of sector-specific initiatives the custom market found itself so in need of a decade ago.

AIMExpo has already been taking a number of steps to deepen its v-twin industry significance.

Those steps have so far included features such as its "Made-in-America" exhibitor showcase, AMD World Championship of Custom Bike Building affiliation for its new Championship of the Americas custom bike contest (the winner will represent the show at the AMD World Championship at INTERMOT in 2016), its new "Garage Party" consumer promotion and its ride-out from the nearby and contemporaneous "Biketoberfest" Rally.

At the time of writing no information was available about whether or not MIC's acquisition of AIMExpo will have a bearing on the show's previously announced intentions of developing a series of regional consumer/industry events around the United States in what had been widely interpreted as an attempt to establish a network of shows to rival Advanstar's Progressive Insurance sponsored multi-city International Motorcycle Show series.

www.aimexpousa.com

International Motorcycle Show Series

FORCED into cancellation of the ill-conceived attempt to revive its Dealer Expo with a pre-Christmas move to Chicago after just one year, the now British owned UBM Advanstar Powersports Group has announced an 11 stop tour for its Progressive International Motorcycle Show series later this year.

In an attempt to salvage something from the near 50-year history of its Dealer Expo, the shows will now incorporate a "business-to-business platform" that will facilitate meetings between manufacturers and dealers in each market."

The new B2B platform is being designed to "serve the educational, information and training needs of dealers in each market." Advanstar say they are acting "in response to industry demand", and that the 2015-16 IMS nationwide tour "business-to-business platform" will provide "vehicle and aftermarket manufacturers and allied services the opportunity to meet with dealers in each of the 11 markets", said Tracy Harris, senior Vice President of the UBM Advanstar Powersports Group.

www.motorcycleshows.com

TecMate

New battery preparation made easy!

IDN interviews TecMate CEO and Chief Technical Officer Martin Human about a problem that can affect many motorcycle dealers...

Correctly preparing and activating a new battery is essential - it guarantees that the battery will perform at full power from the get go and have the best chance of delivering the long service life the manufacturer says it should give.

However, due to time pressure and other issues it is a process that's often overlooked; simply put, a customer buying a new battery at the parts counter is usually anxious to get his vehicle going, or the happy rider about to pull away on the bike he's just collected wants to get going the moment the sale is through. For those customers "come back tomorrow while I finish preparing the battery" just does not work.

Martin Human, the brains behind the OptiMate battery maintenance and diagnostics programme, told IDN...

"The problem with badly prepared batteries is that they will work to begin with, because problems don't emerge until months or even a year later. For dealers poor battery preparation is a potentially expensive gamble - in financial and reputational terms - if it has to be replaced within the warranty period.

"Even with battery acid at full strength when fresh, poor preparation brings the new battery only to 70-80% of deliverable power. Some cells may be at a lower voltage than others, due to some plates within those cells not yet fully interacting with the just-received acid", Martin continued.

He explained that the final 20-30% of power is achieved with controlled charging that gently activates the full surface of each lead plate and thus brings each of the 6 cells to equal voltage. This is the problem that the specifications of his TecMate OptiMate PRO-S (single bank) and OptiMate PRO-4 (4 bank) are designed to deal with - to do this automatically, and quickly with only one hour of charging.

"It’s easy and does not take a lot of time. All the dealer or battery buyer has to do is fill the battery with acid as normal per manufacturer’s recommendations, wait 30-45 minutes for the acid to settle, then select 'NEW' on the OptiMate PRO, hook up the battery and walk away.

"One hour later that new battery is good to go, ready to deliver full power and well prepared to last well past its warranty period - that can be 100% guaranteed if maintained by an OptiMate consumer charger".

OptiMate PRO also revives new batteries that have lost their charge due to being in storage for 3 months or longer, and can also automatically save a sulphated battery that has been discharged down to as little as 1 Volt.

"Once again it is a simple procedure", says Martin. "Simply select 2A or 4A for batteries larger than 10 Amp-hours, hook the battery up and let the OptiMate PRO do the rest.

"We use what we call an 'AmpMatic' micro-processor, and this automatically adjusts the charge voltage and current to match the connected battery’s size and condition. It saves, charges and equalises the cells within the battery, then tests and indicates to the dealer how well the battery recovered".

TECMATE

www.tecmate-int.com

IDN interviews TecMate CEO and Chief Technical Officer Martin Human about a problem that can affect many motorcycle dealers...

Correctly preparing and activating a new battery is essential - it guarantees that the battery will perform at full power from the get go and have the best chance of delivering the long service life the manufacturer says it should give.

However, due to time pressure and other issues it is a process that's often overlooked; simply put, a customer buying a new battery at the parts counter is usually anxious to get his vehicle going, or the happy rider about to pull away on the bike he's just collected wants to get going the moment the sale is through. For those customers "come back tomorrow while I finish preparing the battery" just does not work.

Martin Human, the brains behind the OptiMate battery maintenance and diagnostics programme, told IDN...

"The problem with badly prepared batteries is that they will work to begin with, because problems don't emerge until months or even a year later. For dealers poor battery preparation is a potentially expensive gamble - in financial and reputational terms - if it has to be replaced within the warranty period.

"Even with battery acid at full strength when fresh, poor preparation brings the new battery only to 70-80% of deliverable power. Some cells may be at a lower voltage than others, due to some plates within those cells not yet fully interacting with the just-received acid", Martin continued.

|

| OptiMate PRO, a time and money saver for any powersport dealer wanting to deliver great service and battery performance to their customer |

He explained that the final 20-30% of power is achieved with controlled charging that gently activates the full surface of each lead plate and thus brings each of the 6 cells to equal voltage. This is the problem that the specifications of his TecMate OptiMate PRO-S (single bank) and OptiMate PRO-4 (4 bank) are designed to deal with - to do this automatically, and quickly with only one hour of charging.

"It’s easy and does not take a lot of time. All the dealer or battery buyer has to do is fill the battery with acid as normal per manufacturer’s recommendations, wait 30-45 minutes for the acid to settle, then select 'NEW' on the OptiMate PRO, hook up the battery and walk away.

"One hour later that new battery is good to go, ready to deliver full power and well prepared to last well past its warranty period - that can be 100% guaranteed if maintained by an OptiMate consumer charger".

OptiMate PRO also revives new batteries that have lost their charge due to being in storage for 3 months or longer, and can also automatically save a sulphated battery that has been discharged down to as little as 1 Volt.

"Once again it is a simple procedure", says Martin. "Simply select 2A or 4A for batteries larger than 10 Amp-hours, hook the battery up and let the OptiMate PRO do the rest.

"We use what we call an 'AmpMatic' micro-processor, and this automatically adjusts the charge voltage and current to match the connected battery’s size and condition. It saves, charges and equalises the cells within the battery, then tests and indicates to the dealer how well the battery recovered".

TECMATE

www.tecmate-int.com

Hevik

Hevik rain protection

Hevik rain protectionTHE Italian brand presents its new "pocket" gear, "providing effective protection from unexpected showers.

The garments are the discreet Ultralight 2-piece rain suit and the high visibility Rain Fluo jacket. Both items are extremely compact and can be carried in a storage bag. The waterproof clothing is made in 70-denier Nylon 190T, waterproof for a water of column of up to 3,000 mm. The fabric is extremely light, yet 100% impermeable. To reinforce their watertightness even further, Hevik has equipped its new jackets with pratical sealed seams that avoid water leaking in. Both the Rain Fluo jacket and the Ultralight rain suit rely on windproof material that acts as a shield against cold air whilst commuting by motorcycle or scooter.

Closure of the jackets is by means of a front zipper protected by a Velcro flap. To achieve maximum impenetrability and prevent air leaking through the cuffs, they also feature an eleastic closure with Velcro at the wrists. In an effort to make the motorcyclist safer, Hevik has added reflective inserts on the rear of the jackets.

HEVIK S.r.l.

www.hevik.com

BC Battery Controller

12V socket with USB port

BC BATTERY CONTROLLER has launched what it claims is the only 12V cigar lighter socket with a removable double USB port and a universal support for all kinds of motorcycle handlebars.

The mounting kit included in the P12USB dual pack and the socket are said to be suitable for 22.2mm, 25.4mm and 28.6mm handlebars.

Made in Italy, it is able to charge smartphones, tablets, GPS systems and other electronic devices with the cigar lighter adapter (12V, maximum of 2 amps) or by USB (5V, two ports of 2.1 amp and 1 amp), the 2.1 amp USB port also makes the accessory suitable for the recharge of iPhones and iPads. The double USB port features short-circuit protection and automatic overload cut-off.

Waterproof connections and watertight sealed boot protect the socket, while a protection-fusible with waterproof-fusible holder guarantee safety. The 145mm cable with eyelets can also be used to connect a BC Battery Controller battery charger.

BC BATTERY CONTROLLER

www.batterycontroller.it

BC BATTERY CONTROLLER has launched what it claims is the only 12V cigar lighter socket with a removable double USB port and a universal support for all kinds of motorcycle handlebars.

The mounting kit included in the P12USB dual pack and the socket are said to be suitable for 22.2mm, 25.4mm and 28.6mm handlebars.

Made in Italy, it is able to charge smartphones, tablets, GPS systems and other electronic devices with the cigar lighter adapter (12V, maximum of 2 amps) or by USB (5V, two ports of 2.1 amp and 1 amp), the 2.1 amp USB port also makes the accessory suitable for the recharge of iPhones and iPads. The double USB port features short-circuit protection and automatic overload cut-off.

Waterproof connections and watertight sealed boot protect the socket, while a protection-fusible with waterproof-fusible holder guarantee safety. The 145mm cable with eyelets can also be used to connect a BC Battery Controller battery charger.

BC BATTERY CONTROLLER

www.batterycontroller.it

Bitubo

Bitubo Spring Tester

BASED on his years of personal experience running Italian suspension specialist company Bitubo, Gianni Mardollo's Spring Testing Machine is now available to distributors, dealers, suspension specialists and race teams. Built to be portable with a relatively small size and low weight (making it ideal for race applications) it delivers real-time measurements of spring force and the value of its compression constant with several scales of metric available such as kgf - lbs - N.

It allows force readings on a point-to-point basis, allowing progressive curve analysis with the possibility to print the screen and save the test with all its reference data and to export and store the tests in Excel format. It is available in six languages - Italian, English, German, French, Spanish and Japanese.

BITUBO

www.bitubo.com

BASED on his years of personal experience running Italian suspension specialist company Bitubo, Gianni Mardollo's Spring Testing Machine is now available to distributors, dealers, suspension specialists and race teams. Built to be portable with a relatively small size and low weight (making it ideal for race applications) it delivers real-time measurements of spring force and the value of its compression constant with several scales of metric available such as kgf - lbs - N.

It allows force readings on a point-to-point basis, allowing progressive curve analysis with the possibility to print the screen and save the test with all its reference data and to export and store the tests in Excel format. It is available in six languages - Italian, English, German, French, Spanish and Japanese.

BITUBO

www.bitubo.com

Free Spirits

Upper fork covers

INTERNATIONALLY respected Italian parts and accessory specialist Free Spirits is offering these new upper fork covers for Triumph Bonneville, Thruxton and Scrambler models.

CNC machined from aluminium, then black anodised, they fit between the upper and lower triple trees without altering the steering geometry. Free Spirits say that they are a quick and easy, fully reversible install and that they also have everything needed for the repositioning of the ignition switch, turn signal and removal of the OEM headlight brackets - plus a whole range of additional custom styling and detailing parts, accessories and components for Triumph's popular classics.

FREE SPIRITS S.R.L.

www.freespirits.it

INTERNATIONALLY respected Italian parts and accessory specialist Free Spirits is offering these new upper fork covers for Triumph Bonneville, Thruxton and Scrambler models.

CNC machined from aluminium, then black anodised, they fit between the upper and lower triple trees without altering the steering geometry. Free Spirits say that they are a quick and easy, fully reversible install and that they also have everything needed for the repositioning of the ignition switch, turn signal and removal of the OEM headlight brackets - plus a whole range of additional custom styling and detailing parts, accessories and components for Triumph's popular classics.

FREE SPIRITS S.R.L.

www.freespirits.it

Planet Knox

KNOX say they have taken the traditional waxed cotton motorcycle jacket and given it "a contemporary make-over" with the introduction of the Leonard (for men) and Lea (for women).

Despite the tailored look, the jackets transform quickly into motorcycle-specific wear through the use of an expansion system that allows a body armoured shirt to be worn underneath.

Instead of being fitted with impact protectors at shoulders, elbows and in the back, which makes them too bulky to wear for anything apart from riding, they feature the Knox Dual Fit System. A zip runs from cuff to waist, concealed under the arm. Opening it transforms the jacket, expanding it by one size and allowing enough room to wear a soft stretch fabric Knox armoured shirt, with CE-approved armour at shoulders, elbows and back.

They are waterproof and breathable thanks to a 10k membrane laminated to the inside with fully taped seams.

PLANET KNOX

www.planet-knox.com

Techno Motor Veghel

'Ultra-Tacky' grips

RENTHAL Ultra-Tacky grips have been developed to increase traction between the glove and grip, increasing control and reducing rider fatigue. A unique compound constantly produces and renews a sticky surface coating which, when combined with the Renthal Soft compound, offers "an incredibly grippy yet comfortable surface" for use in all conditions.

The sticky surface will last for the lifetime of the grip, and if it loses its stickiness at any point, simply wash with clean water and allow the grips to air dry to re-activate. They feature a dual compound construction with the outer compound, providing increased traction and the firm inner compound providing durability at grip ends.

Available through Renthal distributors, including Techno Motor Veghel in the Netherlands.

TECHNO MOTOR VEGHEL

www.tmv.nl

RENTHAL Ultra-Tacky grips have been developed to increase traction between the glove and grip, increasing control and reducing rider fatigue. A unique compound constantly produces and renews a sticky surface coating which, when combined with the Renthal Soft compound, offers "an incredibly grippy yet comfortable surface" for use in all conditions.

The sticky surface will last for the lifetime of the grip, and if it loses its stickiness at any point, simply wash with clean water and allow the grips to air dry to re-activate. They feature a dual compound construction with the outer compound, providing increased traction and the firm inner compound providing durability at grip ends.

Available through Renthal distributors, including Techno Motor Veghel in the Netherlands.

TECHNO MOTOR VEGHEL

www.tmv.nl

Friday, 11 September 2015

AIMExpo 2015

AIMExpo - America's "INTERMOT"?

THE American International Motorcycle Expo (AIMExpo) at Orlando, Florida, continues to build momentum as it heads towards its third year (October 15-19, 2015).

Now the only 'mainstream' motorcycle and wider powersports industry expo in the United States (since the closure of Advanstar's Dealer Expo), the AIMExpo formula is new to the United States. It is the first motorcycle industry expo to bring a European INTERMOT style combined OE and aftermarket exhibitor culture to the US market, and the first expo to offer those exhibitors the best of both worlds in business terms - a combined industry and public attendance (October 15th & 16th are trade/dealer only days - the weekend is additionally open to riders).

The reaction to this unique-to-America formula has been overwhelmingly positive, with attendance last year building on year one and expected to grow again this year as acceptance of the concept becomes widespread among the OE motorcycle manufacturing community. In a short time AIMExpo has built an impressive list of motorcycle manufacturer exhibitors, including the likes of Yamaha, Suzuki, Kawasaki, Honda, BMW, Kymco, CF Moto, Zero, CanAm/BRP and Arctic Cat - many of whom are operating outdoor display and test ride opportunities as well as indoor exhibits.

Critically, as AIMExpo deepens its OE manufacturer roots, it will deepen the importance of the show to dealers - the OE involvement could prove to be the magic key that unlocks national dealer attendance; in the past regionalism has been a big criticism and perceived flaw of the traditional trade show formulas in the United States.

With more than three months to go, the total number of exhibitors had surpassed last year's figure with over 500 companies booked in total. The AMA (American Motorcyclist Association) will again be hosting their annual Hall of Fame induction ceremony at AIMExpo, and a whole slew of attendance-driving enthusiast-facing initiatives are set to capitalise on timing that sees the event staged on the same weekend as the long-established and popular Biketoberfest Rally at Daytona Beach, Florida, which is just an hour's ride north east of Orlando.

Those enthusiast-facing initiatives include an AMD World Championship of Custom Bike Building affiliate round - the all new Championship of the Americas - which gives any US expo a big draw for bike builders, trade and consumer attendees; in the case of being based in Florida, for the first time it also gives trade visitors from central and south America a viable business nexus for the first time.

The winner of the Championship of the Americas will receive expenses paid entry to the 2016 AMD World Championship at INTERMOT in October 2016 and the chance to compete against many of Europe's greatest custom bike designers and engineers.

THE American International Motorcycle Expo (AIMExpo) at Orlando, Florida, continues to build momentum as it heads towards its third year (October 15-19, 2015).

Now the only 'mainstream' motorcycle and wider powersports industry expo in the United States (since the closure of Advanstar's Dealer Expo), the AIMExpo formula is new to the United States. It is the first motorcycle industry expo to bring a European INTERMOT style combined OE and aftermarket exhibitor culture to the US market, and the first expo to offer those exhibitors the best of both worlds in business terms - a combined industry and public attendance (October 15th & 16th are trade/dealer only days - the weekend is additionally open to riders).

The reaction to this unique-to-America formula has been overwhelmingly positive, with attendance last year building on year one and expected to grow again this year as acceptance of the concept becomes widespread among the OE motorcycle manufacturing community. In a short time AIMExpo has built an impressive list of motorcycle manufacturer exhibitors, including the likes of Yamaha, Suzuki, Kawasaki, Honda, BMW, Kymco, CF Moto, Zero, CanAm/BRP and Arctic Cat - many of whom are operating outdoor display and test ride opportunities as well as indoor exhibits.

Critically, as AIMExpo deepens its OE manufacturer roots, it will deepen the importance of the show to dealers - the OE involvement could prove to be the magic key that unlocks national dealer attendance; in the past regionalism has been a big criticism and perceived flaw of the traditional trade show formulas in the United States.

With more than three months to go, the total number of exhibitors had surpassed last year's figure with over 500 companies booked in total. The AMA (American Motorcyclist Association) will again be hosting their annual Hall of Fame induction ceremony at AIMExpo, and a whole slew of attendance-driving enthusiast-facing initiatives are set to capitalise on timing that sees the event staged on the same weekend as the long-established and popular Biketoberfest Rally at Daytona Beach, Florida, which is just an hour's ride north east of Orlando.

Those enthusiast-facing initiatives include an AMD World Championship of Custom Bike Building affiliate round - the all new Championship of the Americas - which gives any US expo a big draw for bike builders, trade and consumer attendees; in the case of being based in Florida, for the first time it also gives trade visitors from central and south America a viable business nexus for the first time.

The winner of the Championship of the Americas will receive expenses paid entry to the 2016 AMD World Championship at INTERMOT in October 2016 and the chance to compete against many of Europe's greatest custom bike designers and engineers.

Electric and alternate-powered motorcycles

Electric and alternate-powered motorcycles

Electric and alternate-powered motorcycles in the EU

By ACEM Secretary General Antonio Perlot

An alternative offer with considerable advantages

IN recent years, the motorcycle industry has started developing new electrically and hydrogen-powered models, as well as hybrid vehicles. They emit little or no carbon monoxide and dioxide, hydrocarbons, nitrogen oxides or particulate matter; operate in a smoother manner and consequently have very low sound emissions.

From the user’s point of view, these electric vehicles can be easily charged at home or work, without special charging infrastructure.

Moreover, mopeds, motorcycles and quadricycles running on these ‘alternative fuels’ have substantially lower prices than electric cars, which makes them potentially affordable to a wider range of people, and as a result of their reduced weight and mass, they are a perfect candidate for electrification.

Also, they can take full advantage of the key features of mobility in urban environments: trips in high-traffic density zones, short travelling distances, and limited availability of parking spaces.

… but still very much a niche market

In spite of these comparative advantages, market update remains limited.

According to ACEM’s estimations, only between 1% and 2% of all L-category vehicles (i.e. powered-two and three- wheelers and quadricycles) registered in Europe in 2014 were electric models. It is true that some countries are witnessing an increase in the number of electric vehicles. In the Netherlands, for example, registrations went up from 4,090 units in 2010 to 5,123 units in 2014. In Spain, registered vehicles increased from 165 in 2010 to 1,053 in 2014.

Notwithstanding this, the absolute figures remain at niche levels for now. The fact that some national administrations do not yet distinguish between internal combustion engine and electric engine vehicles in their official statistics is symptomatic of the situation in this segment of the market.

The key barrier to market uptake: charging infrastructure

According to the European Commission, limited charging infrastructure is a major limiting factor in the large scale adoption of electric vehicles, in particular for cars. This is one of the reasons why in 2013, the Commission proposed the Clean Power for Transport package with very ambitious objectives for charging points all over the EU to be achieved by 2020.

However, probably as a result of the delicate situation of public finances in many European countries, the European Transport Ministers rejected the principle of binding targets and proposed a more flexible framework without quantitative objectives. In any case, for the European Commission this issue is still on the table, as its recent Communication on an Energy Union suggests.

The importance of common standards

Another important area of work is harmonisation. Experts from the public and private sectors working together at CEN-CENELEC, the European body responsible for technical standardisation, have defined a standard to harmonise plug-ins for electric L-category vehicles. Although not legally binding yet, this new standard for type 3A plugs sent a clear signal to economic operators.

The European Commission should certainly consider making this standard mandatory through its inclusion in the Directive on the Deployment of Alternative Fuels Infrastructure. This would facilitate the free movement of products within the EU internal market and would increase their acceptance among consumers, providing further possibilities for charging in public spaces.

Creating the adequate fiscal environment

It is also important to remember that a sensitive combination of fiscal and tax incentives would also be required in order to create an adequate environment for the uptake of vehicles running on alternative fuels.

Although some European governments have launched rounds of subsidies to incentivise sales of low or zero-emissions vehicles, powered-two and three wheelers are not always eligible.

This is why in several European countries there is still an unequal playing field between electric mopeds, motorcycles and quadricycles, and other electric means of transport such as cars or buses.

Notwithstanding this, in some countries the situation is starting to change. In the UK, for example, our colleagues from the MCIA have successfully made the case for electric motorcycles and scooters to qualify for subsidies under a new scheme announced by the Office for Low Emission Vehicles (OLEV).

Unlocking the potential of innovation

Co-operative, publicly funded research can be a valuable complement to in-house industry research in the area of e-mobility. In this respect, the European Green Vehicles Initiative (EGVI), a public private partnership funded by both the European Commission and industry, is being instrumental in promoting “smart, green and integrated transport” in Europe.

A concrete example of this: earlier this year, the European Commission decided to allocate €5-8m to the RESOLVE project, an initiative, led by ACEM manufacturers KTM and Piaggio, which will develop new prototypes of vehicles with innovative powertrains.

Projects like RESOLVE illustrate the importance of creating synergies between partners and are an excellent example of co-operation between industry and policy makers. Additional research would be needed in different areas, which would greatly benefit from further European support. And this is one of the key topics we will discuss during our next 2015 annual conference in Brussels.

Summing up…

The models that the motorcycle industry has launched onto the European market, as well as those under development, will certainly contribute to transforming our transport systems and to improving their environmental footprint.

However, whether the share of electric vehicles increases or not will depend mostly on two elements: consumers’ choices and the policies that will be put in place by decision makers.

For the time being, and quite likely for years to come, internal combustion engines will continue to play an important role in transportation.

www.acem.eu

Subscribe to:

Comments (Atom)