Marco De Rossi and Stefano Lavazza have achieved remarkable things since they started their SC- Project exhausts business in Italy a little more than 10 years ago.

Unfortunately, as all too many respectable and respected manufacturers have found to their cost, with success come the product counterfeiters who try and “pass-off” low grade, cheap knock-offs of their products. These products are produced with low-grade, potentially hazardous materials, by forgers with no design or production experience, with no thought given to the serious damage that could be inflicted to bikes and people.

As Stefano says of the SC-Project copies he has found: “Finishing is of the worst quality, the assemblage is extremely inaccurate and the SC-Project logo appears in terrible copies made with polished plate and laser branding of low quality. The assembly is imprecise and the inner soundproofing presents material with amianthus, which is carcinogenic and dangerous for health. Welding is of terrible quality and subject to breaking under even minimal stress, and it is impossible to replicate the precise CNC-engineering undertaken by our specialist equipment”.

The internet in Asia is pock-marked with sites from thieves offering imitation original product – product that is such a poor imitation of the real thing that it is extraordinary that anybody could be fooled by them – sadly though, enough hapless consumers are fooled to make it worth the thieves’ while, and although steps are being increasingly taken to stamp on the counterfeiters, it is likely to be a long time before the practice is completely eliminated, if ever.

|

| This is what cheap gets you – no more words necessary |

Unfortunately, Marco and Stefano aren’t the only people to have seen their Intellectual Property, hard work and massive investments stolen. We here at IDN know that Akrapovic have had similar issues, and it isn’t limited to exhaust manufacturers – as we found out a couple of years ago, when German bullet light specialist Guido Kellermann had to confront the same problem.

|

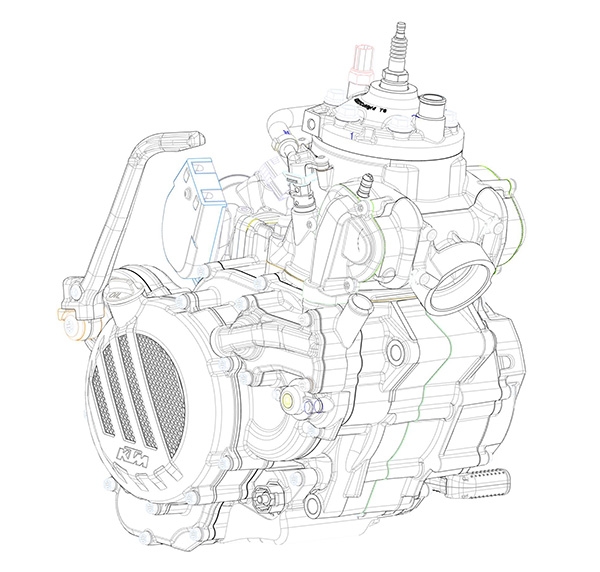

| Original SC-Project quality of the kind that got HRC’s attention |

If we wrote up every known case of counterfeiting, our news pages would be chock-full of such reports every edition, but please, anyone reading this who is facing similar issues, do please let us know.

Organisations such as Koelnmesse, organisers of INTERMOT, have taken radical steps to try to prevent fraudulent product from appearing at their shows, and offer exhibitors access to legal support at their show to get such items confiscated and the vendors concerned barred from the show when such instances do occur.

Their initiative is to be applauded, but we here at IDN call on our industry’s trade associations and our national government trade departments to do more to help their members and their domestic businesses deal with the issues that arise.

The sooner international organisations such as the EU and the World Trade Organisation can also do more to enforce Intellectual Property observance and recognition, especially (but sadly not only) in Asia, the better.

www.sc-project.com/counterfeiting.htm