Airbag Wars - Dainese Vs. Alpinestars part II

Following the news about the apparent legal dispute between Alpinestars and Dainese (concerning aspects of their competitive motorcycle airbag product offerings), Dainese has moved to counter claims made by Alpinestars in a press release that denied that Dainese had taken any legal action against them in Germany (or elsewhere).

According to Alpinestars the dispute centres on an alleged patent infringement concerning the material it uses in the construction of its airbag.

Dainese has countered Alpinestars’ claim that Dainese had not instigated legal proceedings against it by saying that "legal action has in fact been taken in the German market with a Munich court granting an injunction on the sale of Tech-Air products in Germany and that similar action is underway in Italy".

Dainese’s statement says that the Munich court "released two autonomous preliminary injunctions against a German Alpinestars dealer, confirming that the Alpinestars Tech-Air system infringes two Dainese patents in Europe" and that "Dainese has also recently filed, before a German Court, an additional lawsuit against Alpinestars, seeking compensatory damages for infringement of Dainese’s patents and the halting of commercialisation of the Tech-Air system in Germany".

Dainese go on to say that they have "never received a cease-and-desist letter from Alpinestars and that they, Dainese, have [also] filed a lawsuit against Alpinestars before an Italian court, seeking compensatory damages for infringement of Dainese’s patents, as well as an urgent preliminary injunction for halting the commercialisation of the Tech-Air system in Italy".

Dainese say their patents have been "released by the European Patent Office following a long verification procedure, and are therefore registered and fully valid".

This one will run and run!

www.alpinestars.com

www.dainese.com

Friday, 29 January 2016

Spanish motorcycle registrations

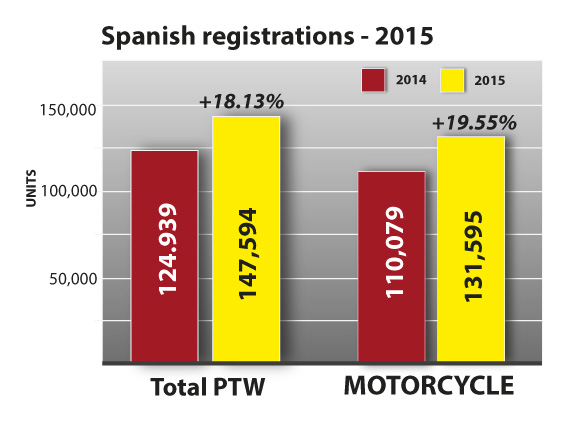

Spanish motorcycle registrations +19.55 percent for 2015

According to the latest data released by the motorcycle trade association in Spain (ANESDOR), the motorcycle market there was up by +34.55 percent (8,447 units) in December and +19.55 percent for the full year (131,595 units).

In moped terms the Spanish market was +29.29 percent in December and +8.95 percent for the year (15,999 units); in total PTW terms the market was +33.78 percent in December and is +18.13 percent for the full year (147,594 units).

ANESDOR say that the market growth in Spain is expected to continue in 2016 with total PTW registrations reaching 162,000 units, further growth of around 9 percent, with motorcycles again expected to be the primary growth sector in the Spanish PTW market.

Jose Maria Riano, the General Secretary of ANEDOR, said that "2015 was a very positive year for the sector in Spain" and that in looking beyond the statistics "the motorcycle is clearly the choice of transport for millions of citizens in Spain, especially for their daily commute - PTWs are a major solution for mobility in Spain, reducing travel times between 50 and 70 percent, and reducing congestion and pollution".

Pointing to the greater age of the PTW fleet in Spain than is the case in neighbouring and nearby countries, he again repeated his call for greater government support for the sector, "the average age of PTWs in Spain is 14.7 years. Despite the growth the fleet actually aged further in 2015. We believe that a review of the financial framework in which the PTW industry operates is needed in Spain, and that simplifying driving licenses would also favour fleet renewal".

Honda led the way in Spain in market share terms in 2015 (21,845 units), followed by Yamaha, Kymco, Piaggio and Suzuki. The top selling model in Spain in 2015 was Kymco's Agility City 125 (5,825 units), followed by Honda's SH 125 and Kymco's Super Dink 125. The top selling large displacement machine in Spain in 2015 was Kawasaki's Z 800 (2,228 units).

Catalonia in North Eastern Spain is the strongest regional market, accounting for 27.5 percent of 2015 registrations, followed by Andalucia (19.5 percent).

According to the latest data released by the motorcycle trade association in Spain (ANESDOR), the motorcycle market there was up by +34.55 percent (8,447 units) in December and +19.55 percent for the full year (131,595 units).

In moped terms the Spanish market was +29.29 percent in December and +8.95 percent for the year (15,999 units); in total PTW terms the market was +33.78 percent in December and is +18.13 percent for the full year (147,594 units).

ANESDOR say that the market growth in Spain is expected to continue in 2016 with total PTW registrations reaching 162,000 units, further growth of around 9 percent, with motorcycles again expected to be the primary growth sector in the Spanish PTW market.

Jose Maria Riano, the General Secretary of ANEDOR, said that "2015 was a very positive year for the sector in Spain" and that in looking beyond the statistics "the motorcycle is clearly the choice of transport for millions of citizens in Spain, especially for their daily commute - PTWs are a major solution for mobility in Spain, reducing travel times between 50 and 70 percent, and reducing congestion and pollution".

Pointing to the greater age of the PTW fleet in Spain than is the case in neighbouring and nearby countries, he again repeated his call for greater government support for the sector, "the average age of PTWs in Spain is 14.7 years. Despite the growth the fleet actually aged further in 2015. We believe that a review of the financial framework in which the PTW industry operates is needed in Spain, and that simplifying driving licenses would also favour fleet renewal".

Honda led the way in Spain in market share terms in 2015 (21,845 units), followed by Yamaha, Kymco, Piaggio and Suzuki. The top selling model in Spain in 2015 was Kymco's Agility City 125 (5,825 units), followed by Honda's SH 125 and Kymco's Super Dink 125. The top selling large displacement machine in Spain in 2015 was Kawasaki's Z 800 (2,228 units).

Catalonia in North Eastern Spain is the strongest regional market, accounting for 27.5 percent of 2015 registrations, followed by Andalucia (19.5 percent).

Ducati

Ducati draXter

Following the launch of Ducati's XDiavel cruiser at the 'Milan show' in November 2015, the company has already unveiled an additional model - the all-new draXter concept.

Described as "interpreting the XDiavel world from a sports viewpoint", the project was developed by the Ducati Design Center's Advanced Design area - "a section dedicated to exploring the future style and design concepts of Ducati motorcycles.

"Their ideas and sketches have allowed the Ducati prototype department to come up with the draXter, starting from a standard production XDiavel. The beating heart of the draXter is that of an extreme dragster with premium racing componentry. This is particularly evident, for example, in the suspension and brakes, taken directly from the Panigale Superbike.

"This styling exercise has accentuated the lines and proportions of the XDiavel, making them more extreme than ever and turning the draXter into a unique, breathtaking "racer".

"The number 90 on the side of the Ducati draXter recalls the racing world, yet also pays homage to Ducati's 90th anniversary, being celebrated this year".

www.ducati.com

Following the launch of Ducati's XDiavel cruiser at the 'Milan show' in November 2015, the company has already unveiled an additional model - the all-new draXter concept.

Described as "interpreting the XDiavel world from a sports viewpoint", the project was developed by the Ducati Design Center's Advanced Design area - "a section dedicated to exploring the future style and design concepts of Ducati motorcycles.

"Their ideas and sketches have allowed the Ducati prototype department to come up with the draXter, starting from a standard production XDiavel. The beating heart of the draXter is that of an extreme dragster with premium racing componentry. This is particularly evident, for example, in the suspension and brakes, taken directly from the Panigale Superbike.

"This styling exercise has accentuated the lines and proportions of the XDiavel, making them more extreme than ever and turning the draXter into a unique, breathtaking "racer".

"The number 90 on the side of the Ducati draXter recalls the racing world, yet also pays homage to Ducati's 90th anniversary, being celebrated this year".

www.ducati.com

Eric Buell Racing

Bill Melvin buys remaining EBR assets

Is the saga of the EBR (Eric Buell Racing) assets sale finally over? Well, yes and no. The sale of the assets in question, the intellectual property and remaining tooling and equipment left after India's Hero Motorcorp (a major EBR investor and shareholder) had bought the assets they laid claimed to, has now been finalized.

At the third time of asking, Bill Melvin's Liquid Asset Partners (LAP) have successfully bid $2.05 million, outmanoeuvring Bruce Belfer (Atlantic Metals Group, New Jersey), the first auction winner, and another potential bidder (US Heritage Powersports). LAP is the company that Harley-Davidson used to sell off the assets of Buell Motorcycles when it closed the business in 2010, and have previously been involved in several other powersports industry asset disposals, such as "Gilroy" Indian, American Ironhorse and Cannondale.

However, there will now therefore be further twists to come in this tale with Melvin now seeking buyers for the assets he has acquired, and having stated that he hoped to be able to see some kind of further reincarnation of the business building bikes again at some stage in the future.

Is the saga of the EBR (Eric Buell Racing) assets sale finally over? Well, yes and no. The sale of the assets in question, the intellectual property and remaining tooling and equipment left after India's Hero Motorcorp (a major EBR investor and shareholder) had bought the assets they laid claimed to, has now been finalized.

|

| Bill Melvin, CEO Liquid Asset Partners: "I believe EBR has established themselves as one of the premier motorcycle manufacturers in the world and has strong potential as a viable business" |

At the third time of asking, Bill Melvin's Liquid Asset Partners (LAP) have successfully bid $2.05 million, outmanoeuvring Bruce Belfer (Atlantic Metals Group, New Jersey), the first auction winner, and another potential bidder (US Heritage Powersports). LAP is the company that Harley-Davidson used to sell off the assets of Buell Motorcycles when it closed the business in 2010, and have previously been involved in several other powersports industry asset disposals, such as "Gilroy" Indian, American Ironhorse and Cannondale.

However, there will now therefore be further twists to come in this tale with Melvin now seeking buyers for the assets he has acquired, and having stated that he hoped to be able to see some kind of further reincarnation of the business building bikes again at some stage in the future.

Italian motorcycle registrations

Italian motorcycle registrations +14 percent for 2015

The latest data released by the motorcycle industry trade association in Italy (ANCMA, Milan) shows new motorcycle registrations there for December up marginally on low volumes - 1,612 units put the market up by +1.45 for the final month of the year.

For the full year 2015 new motorcycle registrations were up by +14.36 percent on 62,449 units - compared to 54,607 units in 2014.

In total PTW terms December was +13.95 percent (4,893 units), and the total PTW market in Italy in 2015 +9.54 percent for the 12 months (171,043 units).

The top selling motorcycle in Italy in 2015 was the BMW R 1200 GS (3,222 units), followed by Yamaha's MT-09 Tracer (2,618 units), the Ducati Scrambler 800 (2,476), Honda's NC 700/750 X (2,292 units) and BMW’s R 1200 GS Adventure (2,006 units).

Honda own all three of the top spots in the Italian Scooter market with over 22,101 of their SH 150/125/300 variants sold in 2015.

Piaggio's Beverley 300 was the fourth best selling scooter (6,168 units), followed by the Kymco Agility 125 R16 (4,598 units).

Naked style bikes (+33.46 percent), Sport bike models (+17.46 percent) and Touring models (+21.24 percent) were the main growth sectors in Italy in 2015, with, as elsewhere in Europe, the strongest growth in motorcycle displacement terms coming in the 751-1000cc market (+8.16 percent) and 501-600cc power band (+5.37 percent).

July was the strongest sales month in Italy, followed by June, April and May; over 72 percent of total PTW sales were made by the end of July in Italy in 2015 with motorcycles (62,449 units out of 171,043 total PTWs) constituting 36.5 percent of unit volume in Italy in 2015.

The latest data released by the motorcycle industry trade association in Italy (ANCMA, Milan) shows new motorcycle registrations there for December up marginally on low volumes - 1,612 units put the market up by +1.45 for the final month of the year.

For the full year 2015 new motorcycle registrations were up by +14.36 percent on 62,449 units - compared to 54,607 units in 2014.

In total PTW terms December was +13.95 percent (4,893 units), and the total PTW market in Italy in 2015 +9.54 percent for the 12 months (171,043 units).

The top selling motorcycle in Italy in 2015 was the BMW R 1200 GS (3,222 units), followed by Yamaha's MT-09 Tracer (2,618 units), the Ducati Scrambler 800 (2,476), Honda's NC 700/750 X (2,292 units) and BMW’s R 1200 GS Adventure (2,006 units).

Honda own all three of the top spots in the Italian Scooter market with over 22,101 of their SH 150/125/300 variants sold in 2015.

Piaggio's Beverley 300 was the fourth best selling scooter (6,168 units), followed by the Kymco Agility 125 R16 (4,598 units).

Naked style bikes (+33.46 percent), Sport bike models (+17.46 percent) and Touring models (+21.24 percent) were the main growth sectors in Italy in 2015, with, as elsewhere in Europe, the strongest growth in motorcycle displacement terms coming in the 751-1000cc market (+8.16 percent) and 501-600cc power band (+5.37 percent).

July was the strongest sales month in Italy, followed by June, April and May; over 72 percent of total PTW sales were made by the end of July in Italy in 2015 with motorcycles (62,449 units out of 171,043 total PTWs) constituting 36.5 percent of unit volume in Italy in 2015.

KTM

KTM revenue exceeds the billion-euro mark for the first time

KTM saw sales and revenue increase again in 2015, setting a record for the company for the fifth year in succession.

Including its Husqvarna brand, the company sold 180,801 units (+14 percent) for revenue of 1,012 billion Euro (+18 percent). KTM is therefore laying claim to being the fastest growing motorcycle brand in the world for years.

The company saw a significant increase in EBIT (Earnings Before Income Tax) to 95 million Euro (+26 percent).

In 2015, KTM invested around 110 million Euro at its Mattighofen and Munderfing facilities in Austria, 30 percent more than in 2014, and now employs some 2,515 people in the KTM Group worldwide.

KTM saw sales and revenue increase again in 2015, setting a record for the company for the fifth year in succession.

Including its Husqvarna brand, the company sold 180,801 units (+14 percent) for revenue of 1,012 billion Euro (+18 percent). KTM is therefore laying claim to being the fastest growing motorcycle brand in the world for years.

The company saw a significant increase in EBIT (Earnings Before Income Tax) to 95 million Euro (+26 percent).

In 2015, KTM invested around 110 million Euro at its Mattighofen and Munderfing facilities in Austria, 30 percent more than in 2014, and now employs some 2,515 people in the KTM Group worldwide.

Yamaha

Will MOTOBOT dream of electric beer?

Yamaha has announced that its humanoid riding robot - MOTOBOT - has "moved into its second phase of development, and that the current partnership in joint development with SRI International is set to continue".

Presentations on the MOTOBOT took place at the Consumer Electronics Show (CES) in Las Vegas in January. Basically it is an automated humanoid robot that is able to ride a non-modified motorcycle - it was first seen at the Tokyo Motor Show in 2015.

The objective is for a riding performance of over 200km/hr on a riding circuit by 2017. In succession from phase one, phase two further develops the platform technology towards actual circuit riding. The sophisticated technologies developed in the project are ultimately intended to be applied to advanced technologies and rider support systems in the future.

The development of the MOTOBOT is progressing as an open innovation model project with SRI, one of the world’s leading research and technology development facilities.

www.yamaha-motor.co.jp

Yamaha has announced that its humanoid riding robot - MOTOBOT - has "moved into its second phase of development, and that the current partnership in joint development with SRI International is set to continue".

Presentations on the MOTOBOT took place at the Consumer Electronics Show (CES) in Las Vegas in January. Basically it is an automated humanoid robot that is able to ride a non-modified motorcycle - it was first seen at the Tokyo Motor Show in 2015.

The objective is for a riding performance of over 200km/hr on a riding circuit by 2017. In succession from phase one, phase two further develops the platform technology towards actual circuit riding. The sophisticated technologies developed in the project are ultimately intended to be applied to advanced technologies and rider support systems in the future.

The development of the MOTOBOT is progressing as an open innovation model project with SRI, one of the world’s leading research and technology development facilities.

www.yamaha-motor.co.jp

Motorcycle Industry Council

More female riders in USA than ever says MIC

More female riders in USA than ever says MICFemale motorcycle ownership is at an all-time high according to the latest data from the Motorcycle Industry Council - having doubled in the past decade. The MIC’s latest Motorcycle Owner Survey found that women account for 14 percent of all U.S. motorcycle owners, well up from the 8 percent reported in 1998.

"Women continue to embrace motorcycling like never before," said Sarah Schilke, National Marketing Manager of BMW Motorrad USA and Chair of PowerLily, a group consisting of female motorcycle industry professionals. "Of the 9.2 million owners, more of them are women than we’ve ever recorded. In fact, the number of female owners better than doubled from 2003 to 2014. And, among the more than 30 million Americans who swung a leg over a motorcycle and rode at least one time in 2014, a quarter of these riders were women."

Among younger generations of owners, the percentage of women is even higher. Slightly more than 17 percent of Gen X owners, and 17.6 percent of Gen Y owners, are women. Among Boomer owners, women make up 9 percent.

"It’s encouraging that we’re seeing more women among the riders who are entering the sport," Schilke said. "Motorcycling is for anyone, and that’s being recognized by younger generations and non-traditional customer segments."

The Owner Survey also revealed what type of bikes women prefer. Cruisers are the choice of 34 percent of female riders. Scooters rank a close second at 33 percent, followed by sport bikes at 10 percent. In the survey, of some 48,000 American households, women were also asked to share their top three reasons for riding motorcycles. They answered "fun and recreation," followed by "sense of freedom" and "enjoy outdoors/nature." When it comes to purchasing a motorcycle, women rate "Fuel Economy" and "Test Rides" as the most important decision-making factors.

The study revealed that female riders are safety-conscious. While 60 percent of women took a motorcycle safety course, only 42 percent of men had any formal training. In some state motorcycle safety training programs, women make up 30 percent of the student population.

The median age for female motorcyclists is 39 versus 48 for males; more than 49 percent of women motorcyclists perform their own maintenance or have a friend or relative do it, instead of taking their bike to a shop; new bikes are preferred over used by 57 percent of female riders; 49 percent of female motorcyclists are married; 47 percent of female motorcyclists have a college or post-graduate degree.

www.mic.org

Motoz

'Tractionator' Adventure and GPS tyres

Following the launch two months ago of their new 'Arena' and ' Xtreme' Hybrid tyres comes news of two new street-able off-road tyres from the specialist Australian manufacturer.

Motoz say their 'Tractionator' Adventure tyre has been designed "by off-road riders, for off-road riders", and that up to 25 percent stronger than many other adventure tyres, it delivers "serious off-road traction".

It is offered in two different compound choices - '4-Seasons' and a 'Summer' compound for hot conditions. The tread is designed to self-protect for long mileage and superior off-road cornering.

As its name suggests, the 'Tractionator' GPS is an adventure tyre for GPS-equipped riders. Motoz say "long mileage, serious traction and smooth transition from pavement to gravel to dirt, the GPS does it all, and well".

It is a reversible tyre to suit all conditions - either 50/50 pavement/off-road, or, fitted the other way round, mostly off-road. In 50/50 direction the GPS is described as a "well behaved street-able tyre with smooth cornering transition from centre to cranked all the way over. In the mostly off-road direction the aggressive straight-line hook-up and cornering drive is engaged".

MOTOZ PTY LTD

www.motoz.com.au

Following the launch two months ago of their new 'Arena' and ' Xtreme' Hybrid tyres comes news of two new street-able off-road tyres from the specialist Australian manufacturer.

Motoz say their 'Tractionator' Adventure tyre has been designed "by off-road riders, for off-road riders", and that up to 25 percent stronger than many other adventure tyres, it delivers "serious off-road traction".

|

| 'Tractionator' Adventure tyre |

It is offered in two different compound choices - '4-Seasons' and a 'Summer' compound for hot conditions. The tread is designed to self-protect for long mileage and superior off-road cornering.

|

| 'Tractionator' GPS tyre |

As its name suggests, the 'Tractionator' GPS is an adventure tyre for GPS-equipped riders. Motoz say "long mileage, serious traction and smooth transition from pavement to gravel to dirt, the GPS does it all, and well".

It is a reversible tyre to suit all conditions - either 50/50 pavement/off-road, or, fitted the other way round, mostly off-road. In 50/50 direction the GPS is described as a "well behaved street-able tyre with smooth cornering transition from centre to cranked all the way over. In the mostly off-road direction the aggressive straight-line hook-up and cornering drive is engaged".

MOTOZ PTY LTD

www.motoz.com.au

Giannelli

X-Pro silencer for Scrambler

Italian exhaust manufacturer Giannelli has released its X-pro silencer for the 2015 Ducati Scrambler. Made in stainless steel (silencer, end cap, internals, mid-pipe and mounting clamp) with black coated 270mm silencer body, it is equipped with baffle/db Killer, and at just 1.3 kg delivers a 3kg weight reduction over the stock exhaust. Dyno tested at 72hp at the rear wheel, it improves stock exhaust rear wheel power delivery by 4hp; meets 97/24/EC/9. Gianneli, Italy; www.giannelli.com

Italian exhaust manufacturer Giannelli has released its X-pro silencer for the 2015 Ducati Scrambler. Made in stainless steel (silencer, end cap, internals, mid-pipe and mounting clamp) with black coated 270mm silencer body, it is equipped with baffle/db Killer, and at just 1.3 kg delivers a 3kg weight reduction over the stock exhaust. Dyno tested at 72hp at the rear wheel, it improves stock exhaust rear wheel power delivery by 4hp; meets 97/24/EC/9. Gianneli, Italy; www.giannelli.com

Thursday, 21 January 2016

EU motorcycle registrations

EU motorcycle registrations +9.3 percent to November 2015

According to the most recent data released by ACEM, the Brussels based international motorcycle industry trade association (Association des Constructeurs Européens de Motocycles), powered-two- and three-wheeler registrations continued to increase in the EU during the first eleven months of 2015, at +3.9%

A total of 1,151,657 powered-two and three-wheelers were registered during the first eleven months of 2015 in the EU.

This represents an increase of +4.4% compared to the 1,102,996 vehicles registered during the same period of 2014.

For the year-to-date registrations performed positively in Spain (138,590 units, +16.7%), the UK (109,542 units, +12.7%), Italy (190,405 units, 6.2%), and Germany (176,711 units, +3.0%). They decreased in France (227,817 units, -4.2%).

In motorcycle terms cumulative motorcycle registrations grew by +9.3% during the first eleven months of 2015 on a year-on year basis. A total of 846,087 motorcycles were registered between January and November 2015, against 774,387 during the same period of 2014.

Year-on-year motorcycle registrations increased in most key European markets, namely Spain (124,020 units, +18.0%), the UK (100,775 units, +15.6%), Italy (167,035 units, +9.8%), Germany (146,862 units, +6.1%). Motorcycle registrations decreased in France (145,303 units, -0.8%).

Motorcycle registrations in Europe's five largest markets (Italy, France, Germany, Spain and the UK) accounted for some 88 percent of EU new motorcycle registrations for the first eleven months of 2015.

A total of 305,570 mopeds were registered during the first eleven months of 2015 in the EU, whilst 328,609 had been registered during the same period of 2014. This represents a decrease of -7.0%. Moped registrations increased in Spain (14,570, +6.2%), although they decreased in Germany (29,849 units, -10.0%), France (82,514 units, -9.5%), the UK (8,767 units, -12.7%), and Italy (23,370 units, -14.1%).

Reference

ACEM’s 2014 annual data shows total EU motorcycle registrations at 798,328 units (up by some 60,000 units over 2013) and at 842,203 units for EU and EFTA markets combined (also some 60,000 units up on 2013).

ACEM’s 2014 annual data shows total EU PTW registrations at 1,099,018 units and at 1,156,569 units for EU and EFTA markets combined (down by some 11,000 units on 2013 in both cases).

ACEM’s 2014 annual data shows total EU moped registrations at 340,468 units (down by some 40,000 units compared to 2013) and at 354,044 units for EU and EFTA markets combined (down by some 42,000 units compared to 2013).

Background

ACEM data is generally published some weeks later than the new registration statistics released by the individual major-market National trade associations and will differ from those numbers for reasons of timing, compilation methodology and the sources used.

ACEM gathers data for as many European markets as possible, including EFTA nations that are outside of their EU reporting (Norway and Switzerland for example), but statistics from some of Europe's smaller EU and EFTA markets (Malta, Cyprus, Bulgaria and Slovakia for example) are not always available within the timescales of ACEM's reporting cycle.

A comprehensive presentation of current and archive data and an ACEM industry newsletter sign-up tool are available at www.acem.eu

According to the most recent data released by ACEM, the Brussels based international motorcycle industry trade association (Association des Constructeurs Européens de Motocycles), powered-two- and three-wheeler registrations continued to increase in the EU during the first eleven months of 2015, at +3.9%

A total of 1,151,657 powered-two and three-wheelers were registered during the first eleven months of 2015 in the EU.

This represents an increase of +4.4% compared to the 1,102,996 vehicles registered during the same period of 2014.

For the year-to-date registrations performed positively in Spain (138,590 units, +16.7%), the UK (109,542 units, +12.7%), Italy (190,405 units, 6.2%), and Germany (176,711 units, +3.0%). They decreased in France (227,817 units, -4.2%).

In motorcycle terms cumulative motorcycle registrations grew by +9.3% during the first eleven months of 2015 on a year-on year basis. A total of 846,087 motorcycles were registered between January and November 2015, against 774,387 during the same period of 2014.

Year-on-year motorcycle registrations increased in most key European markets, namely Spain (124,020 units, +18.0%), the UK (100,775 units, +15.6%), Italy (167,035 units, +9.8%), Germany (146,862 units, +6.1%). Motorcycle registrations decreased in France (145,303 units, -0.8%).

Motorcycle registrations in Europe's five largest markets (Italy, France, Germany, Spain and the UK) accounted for some 88 percent of EU new motorcycle registrations for the first eleven months of 2015.

A total of 305,570 mopeds were registered during the first eleven months of 2015 in the EU, whilst 328,609 had been registered during the same period of 2014. This represents a decrease of -7.0%. Moped registrations increased in Spain (14,570, +6.2%), although they decreased in Germany (29,849 units, -10.0%), France (82,514 units, -9.5%), the UK (8,767 units, -12.7%), and Italy (23,370 units, -14.1%).

Reference

ACEM’s 2014 annual data shows total EU motorcycle registrations at 798,328 units (up by some 60,000 units over 2013) and at 842,203 units for EU and EFTA markets combined (also some 60,000 units up on 2013).

ACEM’s 2014 annual data shows total EU PTW registrations at 1,099,018 units and at 1,156,569 units for EU and EFTA markets combined (down by some 11,000 units on 2013 in both cases).

ACEM’s 2014 annual data shows total EU moped registrations at 340,468 units (down by some 40,000 units compared to 2013) and at 354,044 units for EU and EFTA markets combined (down by some 42,000 units compared to 2013).

Background

ACEM data is generally published some weeks later than the new registration statistics released by the individual major-market National trade associations and will differ from those numbers for reasons of timing, compilation methodology and the sources used.

ACEM gathers data for as many European markets as possible, including EFTA nations that are outside of their EU reporting (Norway and Switzerland for example), but statistics from some of Europe's smaller EU and EFTA markets (Malta, Cyprus, Bulgaria and Slovakia for example) are not always available within the timescales of ACEM's reporting cycle.

A comprehensive presentation of current and archive data and an ACEM industry newsletter sign-up tool are available at www.acem.eu

BMW Motorrad

BMW achieves +10.9 % record sales for 2015

BMW achieves +10.9 % record sales for 2015BMW sold 136,963 vehicles in 2015, up by +10.9 percent over the 123,495 units sold in 2014. Sales were +6.6 percent in December at 7,497 units.

BMW says it experienced growth in all markets worldwide, and that it was the market leader in 26 countries in the premium segment of motorcycles over 500 cc - North America and Europe made the biggest contribution to the increase in sales. Their biggest single market was once again Germany, with 23,823 units sold; 7.4% of total sales for a domestic German market share of more than 25%.

|

| BMW R 1200 GS |

The USA was their second largest market with 16,501 vehicles sold; followed by France (12,550 units), Italy (11,150 units), UK (8,200 units) and Spain (7,976 units).

Stephan Schaller, President BMW Motorrad, said: "We are able to look back on an exceptionally successful year. For the first time in the history of our company we supplied more than 135,000 BMW motorcycles and maxi scooters. I would like to thank our customers most sincerely for the enormous trust they have placed in BMW Motorrad".

With this success, BMW Motorrad has moved closer to achieving its 2020 sales target of 200,000 vehicles. Schaller went on to say: "The 2015 sales figure shows that our motorcycle strategy is taking effect, and based on this strategy we have a lot planned for the years to come. We will continue to consistently pursue our current model offensive in the premium segment over 500 cc, and we will be entering the sub-500 cc market with a genuine BMW machine this year - the G 310 R.

"In the medium-term we will be offering further innovative products in the area of urban mobility and electro mobility. While continuing to extend our sales activities in existing markets, we shall also be penetrating new markets. Asia and South America are very much at the top of our list. Our worldwide dealer network will grow significantly from the current figure of some 1,100 dealerships to a total of 1,500.

"Our product and market offensive will be backed up by a repositioning of the BMW Motorrad brand. Under the brand claim "Make Life A Ride", we will be developing BMW Motorrad further to make it an emotional power brand - though without giving up our traditional qualities of innovation, safety and quality".

The water-cooled R 1200 GS is the most successful BMW motorcycle (23,681 units sold in 2015); the R series, with the hallmark boxer engine, made the biggest single contribution to total sales accounting for 53.6 percent of total sales, i.e. 73,357 vehicles.

The next most popular BMW models were the R 1200 Adventure (18,011 units) and the R 1200 RT (10,955 units). The BMW R nineT sold 9,545 units in its second year of production, followed by the R 1200 R (6,951 units) and the new R 1200 RS touring sports bike next, selling 4,208 units.

S-Series sales totalled 21,110 units, with the S 1000 RR the top seller and fourth most popular BMW overall with 9,576 units sold; the S 1000 R sold 6,473 units; the S 1000 XR sold 5,061 units.

The 2-cylinder mid-range models F 800 GS/GS Adventure sold 6,603 units and 4,129 units respectively, with the F 700 GS selling 6,282 units, and 5,971 F 800 R sold and 2,631 of the F 800 GT sold. 25,616 F-Series models were sold overall.

The K 1600 GT, GTL and GTL Exclusive fitted with the BMW in-line 6-cylinder engine sold 4,866 units; the maxi scooters C 650 GT and C 600 Sport sold 4,530 units in the last year before their model change. Sales of the electrically powered scooter, the BMW C evolution, remained "on track" with 957 units.

Looking ahead to 2016, Schaller said: "From spring to summer 2015 we launched no less than five new models - the F 800 R, the S 1000 RR, the R 1200 R and RS, and also the S 1000 XR. These made a crucial contribution to the sales success of BMW Motorrad. In the 2016 season, too, innovative and emotional vehicles will be added to the BMW Motorrad portfolio. Since the New Year got underway, the thoroughly revised C 650 maxi scooters have already become available on the market.

|

| The new BMW R nineT Scrambler |

"In the second half of the year, these will be followed by the second model of the BMW Heritage world of experience, the new BMW R nineT Scrambler, as well as the first model of our sub-500 cc programme, the new BMW G 310 R.

"The signals we are getting from the markets are making us confident and optimistic. Motorcycles are clearly on an upward trend once again. There is a positive mood in the motorcycle markets of Europe and America, and we are intensifying our efforts in Asia as well – especially in China".

German motorcycle registrations

German motorcycle registrations +5.59 percent for 2015

According to the latest data released by the motorcycle industry trade association in Germany (IVM, Essen), new motorcycle registrations in December were up by +12.83 percent on low volumes (2,647 units), leaving the German market with a healthy +5.59 percent growth for the full year (102,235 units) - the best German market performance since 2009.

In total PTW terms December was up by +48.30 percent (4,750 units) in Germany and is +7.07 percent (at 150,550 units) for the year-to-date - the best annual market performance in Germany since 2008.

The top-selling motorcycle in Germany in 2015 was BMW’s R 1200 GS (7,225 units), followed by Yamaha's MT-07 (3,184 units) and BMW’s R nineT (2,650 units), with the Kawasaki ER-6n fourth and Yamaha MT-09 fifth.

Seven out of the top 20 best selling motorcycles in Germany last year were BMW models.

The top-selling motorcycle manufacturer in Germany in 2015 was therefore BMW with 16.14 percent market share (24,293 units, +5.65 percent compared to 2014), with Yamaha second with 13.25 percent of the German motorcycle market (19,953 units, +25.97 percent) and Honda third with 11.66 percent market share (17,550 units, -3.19 percent) on their 2014 market share.

KTM are fourth with a +8.62 percent market share (12,978 units), which is up by 6.89 percent on their 2014 share, with Kawasaki fifth (7.13 percent share, 10,730 units, up by +6.89 percent on 2014) and Harley-Davidson sixth with a 6.55 percent share (9,857 units, down -6.82 percent). Piaggio are sixth (down by -2.56 percent); Suzuki eighth (+14.26 percent); Ducati ninth (up by a massive +23.54 percent, selling 5,751 units, 1,662 of which were Scramblers); and Triumph tenth (-10.71 percent, 5,009 units).

According to the latest data released by the motorcycle industry trade association in Germany (IVM, Essen), new motorcycle registrations in December were up by +12.83 percent on low volumes (2,647 units), leaving the German market with a healthy +5.59 percent growth for the full year (102,235 units) - the best German market performance since 2009.

In total PTW terms December was up by +48.30 percent (4,750 units) in Germany and is +7.07 percent (at 150,550 units) for the year-to-date - the best annual market performance in Germany since 2008.

The top-selling motorcycle in Germany in 2015 was BMW’s R 1200 GS (7,225 units), followed by Yamaha's MT-07 (3,184 units) and BMW’s R nineT (2,650 units), with the Kawasaki ER-6n fourth and Yamaha MT-09 fifth.

Seven out of the top 20 best selling motorcycles in Germany last year were BMW models.

The top-selling motorcycle manufacturer in Germany in 2015 was therefore BMW with 16.14 percent market share (24,293 units, +5.65 percent compared to 2014), with Yamaha second with 13.25 percent of the German motorcycle market (19,953 units, +25.97 percent) and Honda third with 11.66 percent market share (17,550 units, -3.19 percent) on their 2014 market share.

KTM are fourth with a +8.62 percent market share (12,978 units), which is up by 6.89 percent on their 2014 share, with Kawasaki fifth (7.13 percent share, 10,730 units, up by +6.89 percent on 2014) and Harley-Davidson sixth with a 6.55 percent share (9,857 units, down -6.82 percent). Piaggio are sixth (down by -2.56 percent); Suzuki eighth (+14.26 percent); Ducati ninth (up by a massive +23.54 percent, selling 5,751 units, 1,662 of which were Scramblers); and Triumph tenth (-10.71 percent, 5,009 units).

Ducati

Ducati announces record sales and strong growth for 2015

Ducati closed 2015 with its best-ever results, confirming the positive trend of the last five years that has seen a consistent increase in sales and production. With 54,800 bikes sold during 2015, Ducati set a new record by delivering 9,683 more bikes to customers than in 2014, an increase of +22%.

“The record sales of 2015 are the result of our company’s courage and skill”, stated Claudio Domenicali, CEO of Ducati Motor Holding. “Ducati closed 2015 with record volumes and also a substantial growth of 22% over 2014. During the year Ducati not only launched successful new motorcycles, but also a new brand, Ducati Scrambler, which immediately won global acclaim with over 16,000 sales worldwide.”

“This impressive performance, a landmark one for Ducati, confirms the soundness of the strategy of expansion and consolidation in global markets and highlights the energy and professionalism of the over 700 dealers who cover no less than 90 countries”, commented Andrea Buzzoni, Global Sales and Marketing Director of Ducati Motor Holding.

“Such growth confirms, in the vast majority of countries, the validity of both our products and our strategy: indeed, for the first time in Ducati’s history, one of our bikes, the Ducati Scrambler, made it into the ‘Top 10’ list of the world’s best-selling bikes”.

The year 2015 also saw a marked increase in Ducati sales in Europe where, again compared to 2014, the biggest gains were made in the Italian market with +53%, in the UK with +37%, in Germany with +24% and in France with +22%.

2015 was also a year of expansion in the USA, which confirmed its status as the number one market: Ducati North America achieved a 14% increase in sales over 2014.

In terms of quantity of sales, 2015 ended with Italy in second place, accounting for 12% of the total. Ducati’s third biggest market remains Germany, followed by France and the UK.

Asian Pacific markets also experienced growth, with sales up by 14% on the 2014 figure: the results in China - which closed 2015 with a staggering 46% increase – were particularly noteworthy.

The best-selling Ducati in 2015 was the Ducati Scrambler, with 16,000 bikes sold during the 12-month period. In its wake comes the new Multistrada 1200, with over 8,000 bikes sold, and the new Monster 821, with some 6,500 bikes sold worldwide. It was also a good year, in order of sales performance, for the 1299 Panigale, the 899 Panigale and the Diavel.

Ducati closed 2015 with its best-ever results, confirming the positive trend of the last five years that has seen a consistent increase in sales and production. With 54,800 bikes sold during 2015, Ducati set a new record by delivering 9,683 more bikes to customers than in 2014, an increase of +22%.

|

| Ducati CEO Claudio Domenicali: "Ducati closed 2015 with record volumes plus a significant 22% growth over 2014" |

“The record sales of 2015 are the result of our company’s courage and skill”, stated Claudio Domenicali, CEO of Ducati Motor Holding. “Ducati closed 2015 with record volumes and also a substantial growth of 22% over 2014. During the year Ducati not only launched successful new motorcycles, but also a new brand, Ducati Scrambler, which immediately won global acclaim with over 16,000 sales worldwide.”

“This impressive performance, a landmark one for Ducati, confirms the soundness of the strategy of expansion and consolidation in global markets and highlights the energy and professionalism of the over 700 dealers who cover no less than 90 countries”, commented Andrea Buzzoni, Global Sales and Marketing Director of Ducati Motor Holding.

“Such growth confirms, in the vast majority of countries, the validity of both our products and our strategy: indeed, for the first time in Ducati’s history, one of our bikes, the Ducati Scrambler, made it into the ‘Top 10’ list of the world’s best-selling bikes”.

The year 2015 also saw a marked increase in Ducati sales in Europe where, again compared to 2014, the biggest gains were made in the Italian market with +53%, in the UK with +37%, in Germany with +24% and in France with +22%.

|

| Ducati Director Sales & Marketing Andrea Buzzoni - "For the first time ever a Ducati bike has made it into the list of the world’s Top 10 best-selling bikes" |

2015 was also a year of expansion in the USA, which confirmed its status as the number one market: Ducati North America achieved a 14% increase in sales over 2014.

In terms of quantity of sales, 2015 ended with Italy in second place, accounting for 12% of the total. Ducati’s third biggest market remains Germany, followed by France and the UK.

Asian Pacific markets also experienced growth, with sales up by 14% on the 2014 figure: the results in China - which closed 2015 with a staggering 46% increase – were particularly noteworthy.

The best-selling Ducati in 2015 was the Ducati Scrambler, with 16,000 bikes sold during the 12-month period. In its wake comes the new Multistrada 1200, with over 8,000 bikes sold, and the new Monster 821, with some 6,500 bikes sold worldwide. It was also a good year, in order of sales performance, for the 1299 Panigale, the 899 Panigale and the Diavel.

Marzocchi

Suspension maker Marzocchi saved

Suspension maker Marzocchi savedItalian suspension specialist Marzocchi has been saved from liquidation.

American owner Tenneco (the $8.4 bn turnover owner of Monroe shocks and other automotive interests) had been intending to close the business, but Italian automotive engineer VRM S.p.A., also based near Bologna, has acquired the business for an undisclosed sum in a deal brokered by local government and trade union officials.

VRM is a precision engineering company with chassis component contracts with the likes of BMW, Ducati and MV Agusta among others. The deal does not include Marzocchi's bicycle/MTB suspension programmes - those assets were sold to Fox in October 2015. The deal will save some 70 remaining jobs, and reports suggest that production of some of the product lines that Marzocchi produced for major motorcycle OEs will recommence quickly.

Founded in 1949, Marzocchi's core market for motorcycle suspensions has always been OE contracts, but the brand has always been a popular choice with aftermarket customisers and builders looking for beefed-up and performance-capable suspensions. There is no word yet as to whether VRM will sell to the aftermarket.

Tenneco acquired Marzocchi in 2008, just as the bottom started to fall out of Marzocchi's market. It is believed that the changes taking place in the suspension industry, with the spread of electronically controlled and adjusted and semi-active electronic suspension systems rapidly becoming a de facto standard requirement for OE product, meant that the huge investment that would have been required to allow Marzocchi to compete became untenable for the American parent company. It is believed that Tenneco was facing a bill of close to $30m for closure of Marzocchi.

UK motorcycle registrations

UK motorcycle registrations +15.59 percent for 2015

The latest data released by the motorcycle industry trade association in the UK (MCIA) shows that new motorcycle registrations there for December were up by +14.33 percent (4,556 units - the best December figure in the UK for nearly a decade) and +15.59 percent for the year (104,813 units).

In total PTW terms, December was +16.68 percent (5,177 units), and the total PTW market in the UK was +12.72 percent for the year (114,160 units). Total moped sales in the UK were down by -11.8 percent in 2015 (10,598 units).

The 'Naked' style (+26.9 percent/30,108 units) and Adventure Sport sectors (+26.8 percent/16,653 units) were the strongest growth markets in the UK in 2015, with traditional Touring models the primary loser in the UK in 2015 (15.7 percent). Custom style bikes were up by +14.1 percent (9,270 units) for the year in the UK, with Supersport models +11.6 percent for the year (13,320 units) and trails/enduro style models +13.3 percent (5,581 units).

In displacement terms, as elsewhere in Europe, the fastest growing sector of the market in the UK is the 'middleweight' 651 - 1000cc market, which was +24.9 percent in 2015. Scooter sales in the UK (31,570 units) were basically 'flat' in 2015 at +0.9 percent.

Honda were market share leaders in the UK in December, selling 918 units; followed by Yamaha, Lexmoto, BMW, KTM, Kawasaki, Triumph, Piaggio, Suzuki and Ducati.

The UK 'bike park' is now said to stand at 1.2 million units - a figure that has remained largely static since 2011; 34,600 people passed the motorcycle rider test in the UK in 2014/15 - which is some 4,000 more than in the previous 12 months, and the MCIA says that some 4.6 billion km (2.8 billion miles) were ridden on two wheels on the roads in the UK in 2014 - a figure that has remained largely static since 2011.

The latest data released by the motorcycle industry trade association in the UK (MCIA) shows that new motorcycle registrations there for December were up by +14.33 percent (4,556 units - the best December figure in the UK for nearly a decade) and +15.59 percent for the year (104,813 units).

In total PTW terms, December was +16.68 percent (5,177 units), and the total PTW market in the UK was +12.72 percent for the year (114,160 units). Total moped sales in the UK were down by -11.8 percent in 2015 (10,598 units).

The 'Naked' style (+26.9 percent/30,108 units) and Adventure Sport sectors (+26.8 percent/16,653 units) were the strongest growth markets in the UK in 2015, with traditional Touring models the primary loser in the UK in 2015 (15.7 percent). Custom style bikes were up by +14.1 percent (9,270 units) for the year in the UK, with Supersport models +11.6 percent for the year (13,320 units) and trails/enduro style models +13.3 percent (5,581 units).

In displacement terms, as elsewhere in Europe, the fastest growing sector of the market in the UK is the 'middleweight' 651 - 1000cc market, which was +24.9 percent in 2015. Scooter sales in the UK (31,570 units) were basically 'flat' in 2015 at +0.9 percent.

Honda were market share leaders in the UK in December, selling 918 units; followed by Yamaha, Lexmoto, BMW, KTM, Kawasaki, Triumph, Piaggio, Suzuki and Ducati.

The UK 'bike park' is now said to stand at 1.2 million units - a figure that has remained largely static since 2011; 34,600 people passed the motorcycle rider test in the UK in 2014/15 - which is some 4,000 more than in the previous 12 months, and the MCIA says that some 4.6 billion km (2.8 billion miles) were ridden on two wheels on the roads in the UK in 2014 - a figure that has remained largely static since 2011.

Rizoma

Rizoma Scrambler interpretations

Like so many, Italian parts specialist Rizoma has turned its attention to the Ducati Scrambler, with two projects unveiled at EICMA - the Cafe Racer style 'HELL' and Flat Track racer style version.

Products across the two very differently styled interpretations include replacement handlebars, 1 1/8" tapered bars for the flat tracker and clip-ons with aluminium clamps for the cafe racer; gauge brackets, riser kits, handlebar end caps, grips, levers, covers, screens, fenders, fork tube guards, adjustable foot control sets, chain guards, license plate support brackets, gas caps, engine guards, axle sliders, mirrors and more.

The Ducati Scrambler is just one of the popular current production bikes to have received the Rizoma treatment - they recently also launched products for the BMW R 1200 R/GS and S 1000 R/RR.

RIZOMA

www.rizoma.com

Like so many, Italian parts specialist Rizoma has turned its attention to the Ducati Scrambler, with two projects unveiled at EICMA - the Cafe Racer style 'HELL' and Flat Track racer style version.

Products across the two very differently styled interpretations include replacement handlebars, 1 1/8" tapered bars for the flat tracker and clip-ons with aluminium clamps for the cafe racer; gauge brackets, riser kits, handlebar end caps, grips, levers, covers, screens, fenders, fork tube guards, adjustable foot control sets, chain guards, license plate support brackets, gas caps, engine guards, axle sliders, mirrors and more.

The Ducati Scrambler is just one of the popular current production bikes to have received the Rizoma treatment - they recently also launched products for the BMW R 1200 R/GS and S 1000 R/RR.

RIZOMA

www.rizoma.com

Gianni Falco

Touring and Urban line for women

Touring and Urban line for womenEICMA saw Italian specialist Falco introduce their new Touring and Urban lines for women. The Touring line includes the new Eve boot, intended for women who want a comfortable boot for on and off the motorcycle. Eve is a classic leather boot with all the comfort and safety features riders expect from a CE-approved design - reinforcements on shin, toe and heel, inserts in anti-shock D3O material on the ankles and an inner "High-Tex" membrane and large elastic inserts for optimum fit in the calf area.

The Urban line includes the new CE-approved Kamila 2 technical shoe "characterised by style and comfort designed especially for the female foot". The upper is made of genuine oiled leather with vintage effect, and the inner lining is equipped with a "High-Tex" membrane. Toe, heel and ankles have thermo-formed reinforcements and a dual compound outsole provides "optimum grip".

GIANNI FALCO Srl

www.giannifalco.com

CMS Helmets

GTRS Carbon Race Tech and Vintage tri-composite

Among the new helmet models presented at EICMA by Portuguese helmet manufacturer CMS Helmets was their latest GTRS Carbon Race Tech, fully constructed from large multiaxial carbon fiber, based on s-matrix technology. This new development comes from a technological process that combines multiaxial special wide weave carbon fibre, optimising resistance, lightness and flexibility.

The inner lining is fully removable and washable, using Sanitised technology with hypo-allergenic, anti-bacterial and anti-fungal properties.

The new GTRS tri-composite was unveiled in a variety graphics and colourways and the brand also increased its vintage collection, with the Vintage Sportster, Roadster and Legend designs inspired by retro designs of the 60s and 70s.

CMS HELMETS

www.cms-helmets.com

Among the new helmet models presented at EICMA by Portuguese helmet manufacturer CMS Helmets was their latest GTRS Carbon Race Tech, fully constructed from large multiaxial carbon fiber, based on s-matrix technology. This new development comes from a technological process that combines multiaxial special wide weave carbon fibre, optimising resistance, lightness and flexibility.

The inner lining is fully removable and washable, using Sanitised technology with hypo-allergenic, anti-bacterial and anti-fungal properties.

The new GTRS tri-composite was unveiled in a variety graphics and colourways and the brand also increased its vintage collection, with the Vintage Sportster, Roadster and Legend designs inspired by retro designs of the 60s and 70s.

CMS HELMETS

www.cms-helmets.com

Arrow

Panigale power increase choices

From Italian exhaust specialist Arrow, these slip-ons for the Panigale 899 and 1199 are based on their popular Works and GP2 silencers, with new design features and exhaust layout, and a good weight reduction for improved performance. The exhaust gases pass through the left silencer to be redirected to the right-hand one with a C-shaped link pipe, therefore only the right-hand silencer has an exit pipe. Arrow says this was the key to reduce the weight and dimensions; the 899 scored 134 PS at the rear wheel in racing version (an increase of 5 PS over OE exhaust), with the 1199 reaching 174 PS - an improvement of 6 PS over the OE system. Available as homologated Works silencers with carbon end cap or GP2 silencers in titanium for the original collectors, or as a GP2 "Dark" silencer for the original collector in steel. Arrow, Italy; www.arrow.it

From Italian exhaust specialist Arrow, these slip-ons for the Panigale 899 and 1199 are based on their popular Works and GP2 silencers, with new design features and exhaust layout, and a good weight reduction for improved performance. The exhaust gases pass through the left silencer to be redirected to the right-hand one with a C-shaped link pipe, therefore only the right-hand silencer has an exit pipe. Arrow says this was the key to reduce the weight and dimensions; the 899 scored 134 PS at the rear wheel in racing version (an increase of 5 PS over OE exhaust), with the 1199 reaching 174 PS - an improvement of 6 PS over the OE system. Available as homologated Works silencers with carbon end cap or GP2 silencers in titanium for the original collectors, or as a GP2 "Dark" silencer for the original collector in steel. Arrow, Italy; www.arrow.it

Thursday, 14 January 2016

Motorcycle Trade Expo 2016

"If it’s new, it’s at EXPO"

By Andy Mayo, of British Dealer News and co-organiser of Motorcycle Trade Expo

Europe’s biggest motorcycle trade show opens at Stoneleigh Park near Coventry, UK, on the 24th January, in time to help dealers save money and boost their profits by stocking all the latest products, bikes, scooters and services.

Motorcycle Trade Expo (24-26 January) has attracted more than 175 exhibitors keen to showcase their 2016 ranges. As a taster, BDN’s bumper 84-page Show Guide previews all exhibitor offerings, has a 15-page preview of new product launches, and carries news of an array of money-saving Expo-only special offers.

Entry to the show (and parking!) is free, as is the help and advice provided by business and legal experts at the ever-popular "Knowledge Shop".

For the first time, Expo 2016 has a Training Provider Area to bring dealers up-to-date with the demands of new technology in the workshop. Technicians increasingly face unfamiliar technology, and proper training can save time and money.

On the subject of boosting profits, increasing numbers of dealers are taking on electric bicycles, or pedelecs, which feature heavily at this year’s show. Public demand for pedelecs is growing and exhibitors report huge increases in sales.

Last year was the best for the powered two-wheeler industry in the UK since 2008 and, with registrations for the 12 months confidently predicted to hit 114,000 and reach around 124,000 in 2016, this would be a great time to attend Expo and make the best possible preparation for 2016.

Visiting dealers also have a great chance of winning £1,000s in the Expo mega-prize draw. Free entry tickets are available from the website:

www.motorcycle-expo.com

By Andy Mayo, of British Dealer News and co-organiser of Motorcycle Trade Expo

Europe’s biggest motorcycle trade show opens at Stoneleigh Park near Coventry, UK, on the 24th January, in time to help dealers save money and boost their profits by stocking all the latest products, bikes, scooters and services.

Motorcycle Trade Expo (24-26 January) has attracted more than 175 exhibitors keen to showcase their 2016 ranges. As a taster, BDN’s bumper 84-page Show Guide previews all exhibitor offerings, has a 15-page preview of new product launches, and carries news of an array of money-saving Expo-only special offers.

Entry to the show (and parking!) is free, as is the help and advice provided by business and legal experts at the ever-popular "Knowledge Shop".

For the first time, Expo 2016 has a Training Provider Area to bring dealers up-to-date with the demands of new technology in the workshop. Technicians increasingly face unfamiliar technology, and proper training can save time and money.

On the subject of boosting profits, increasing numbers of dealers are taking on electric bicycles, or pedelecs, which feature heavily at this year’s show. Public demand for pedelecs is growing and exhibitors report huge increases in sales.

Last year was the best for the powered two-wheeler industry in the UK since 2008 and, with registrations for the 12 months confidently predicted to hit 114,000 and reach around 124,000 in 2016, this would be a great time to attend Expo and make the best possible preparation for 2016.

Visiting dealers also have a great chance of winning £1,000s in the Expo mega-prize draw. Free entry tickets are available from the website:

www.motorcycle-expo.com

Dainese and Alpinestars

Italian apparel majors in airbag wars

It was always going to happen at some stage - Dainese and Alpinestars appear to be in legal dispute over their airbag technology designs.

Alpinestars has responded to Dainese sending some of its German dealers "cease and desist from selling" threats with a statement that seeks to correct what it sees as erroneous press reports about an allegation by Dainese that it has infringed patents connected with the gas inflation technology and construction of its Tech-Air Street Airbag system.

The allegations made by Dainese S.p.A in proceedings launched in Italy against Alpinestars refer to the assembly of the bag itself, the physical material piece that contains the gas in an inflation and "not with any reference to any other parts or Alpinestars’ Tech-Air street system’s use of an algorithm for registering when the airbag deployment should occur".

Alpinestars says that Dainese instead "makes claims that the physical construction of the bag in the Tech-Air system infringes upon Dainese patents" and that "in Germany, Dainese has made direct requests to certain retailers, that they cease and desist from offering for sale the Alpinestars Tech-Air Street system" but that "no legal action has been taken against Alpinestars and neither has Alpinestars withdrawn any of its products from the German market".

Launched in November 2014, Alpinestars says its Tech-Air Street system was the world’s first "self-contained street airbag system that independently functions without the need for sensors to be installed on the bike and the subsequent need to link a specific motorcycle to the airbag system used by the rider".

Alpinestars says that all claims made against them and/or their retailers by Dainese "are disputed" and that it is "taking the appropriate legal measures to ensure that any such unfounded allegations will not prevent distribution and sales of the Tech-Air Street system".

Alpinestars points to its own research and development at its in-house Advanced Technology Department, undertaken since 2001, and says that its Tech-Air Street system is based on its own technology creation, and the physical bag used is from "known airbag technology, used within the automotive industry", and that it "does not infringe upon third parties' intellectual property rights".

www.alpinestars.com

www.dainese.com

It was always going to happen at some stage - Dainese and Alpinestars appear to be in legal dispute over their airbag technology designs.

Alpinestars has responded to Dainese sending some of its German dealers "cease and desist from selling" threats with a statement that seeks to correct what it sees as erroneous press reports about an allegation by Dainese that it has infringed patents connected with the gas inflation technology and construction of its Tech-Air Street Airbag system.

The allegations made by Dainese S.p.A in proceedings launched in Italy against Alpinestars refer to the assembly of the bag itself, the physical material piece that contains the gas in an inflation and "not with any reference to any other parts or Alpinestars’ Tech-Air street system’s use of an algorithm for registering when the airbag deployment should occur".

Alpinestars says that Dainese instead "makes claims that the physical construction of the bag in the Tech-Air system infringes upon Dainese patents" and that "in Germany, Dainese has made direct requests to certain retailers, that they cease and desist from offering for sale the Alpinestars Tech-Air Street system" but that "no legal action has been taken against Alpinestars and neither has Alpinestars withdrawn any of its products from the German market".

Launched in November 2014, Alpinestars says its Tech-Air Street system was the world’s first "self-contained street airbag system that independently functions without the need for sensors to be installed on the bike and the subsequent need to link a specific motorcycle to the airbag system used by the rider".

Alpinestars says that all claims made against them and/or their retailers by Dainese "are disputed" and that it is "taking the appropriate legal measures to ensure that any such unfounded allegations will not prevent distribution and sales of the Tech-Air Street system".

Alpinestars points to its own research and development at its in-house Advanced Technology Department, undertaken since 2001, and says that its Tech-Air Street system is based on its own technology creation, and the physical bag used is from "known airbag technology, used within the automotive industry", and that it "does not infringe upon third parties' intellectual property rights".

www.alpinestars.com

www.dainese.com

Japanese manufacturer motorcycle exports

Japanese manufacturer motorcycle exports to Europe down by over 7 percent for first 11 months of 2015

According to the latest data released by the motorcycle industry trade association in Japan (JAMA), Japanese motorcycle manufacturer exports to Europe declined again in November, down by -18.33 percent (12,835 units) and stand at 129,318 units for the first 11 months of 2015 (-7.88 percent).

In total PTW terms, exports to Europe were -16.46 percent in November (14,124 units) and are down at -5.86 percent for the first 11 months of 2015 (146,765 units).

The picture continues to be bad for Japanese made motorcycle exports to the United States, with November down at -53.84 percent (6,426 units) compared to November 2014 and down by -33.25 percent for the first 11 months of 2015 (72,202 units).

The increasing number of units being made by the Japanese brands elsewhere in Asia, the US and South/Central America goes some way to explaining the data, though the majority of higher value larger displacement machines are still made in Japan with their overseas factories primarily engaged in making and selling scooters and smaller cc units in 'emerging' markets (where import tariffs are high) and making ATV/UTV units - especially in the United States.

Total worldwide Japanese manufacturer motorcycle production is on the increase though, with this year's annual total expected to be higher than the 597,058 units produced by them in 2014 (563,309 units in 2013). However, in 2007 (for example), prior to the global economic downturn, the Japanese manufacturers were producing more than double that figure at 1,676,097 units worldwide.

www.jama.org

According to the latest data released by the motorcycle industry trade association in Japan (JAMA), Japanese motorcycle manufacturer exports to Europe declined again in November, down by -18.33 percent (12,835 units) and stand at 129,318 units for the first 11 months of 2015 (-7.88 percent).

In total PTW terms, exports to Europe were -16.46 percent in November (14,124 units) and are down at -5.86 percent for the first 11 months of 2015 (146,765 units).

The picture continues to be bad for Japanese made motorcycle exports to the United States, with November down at -53.84 percent (6,426 units) compared to November 2014 and down by -33.25 percent for the first 11 months of 2015 (72,202 units).

The increasing number of units being made by the Japanese brands elsewhere in Asia, the US and South/Central America goes some way to explaining the data, though the majority of higher value larger displacement machines are still made in Japan with their overseas factories primarily engaged in making and selling scooters and smaller cc units in 'emerging' markets (where import tariffs are high) and making ATV/UTV units - especially in the United States.

Total worldwide Japanese manufacturer motorcycle production is on the increase though, with this year's annual total expected to be higher than the 597,058 units produced by them in 2014 (563,309 units in 2013). However, in 2007 (for example), prior to the global economic downturn, the Japanese manufacturers were producing more than double that figure at 1,676,097 units worldwide.

www.jama.org

EICMA 2015 Part IV

EICMA 2015 part IV

Motoweek presents a selection of "Milan Show" exhibitor and product news. In a year that saw long-delayed R&D investments finally result in a tsunami of new product initiatives, exhibitors capitalised on the positive business environment and strong international industry visitor attendance seen this year ...

BREMBO: The company reported +15.6 percent growth in global sales revenues across the group for the nine months to September 2015; the motorcycle market is 9.7 percent of Brembo's total sales revenue and was +10.6 percent for the first nine months of 2015; www.brembo.com

AMPHIBIOUS: Six new products launched at EICMA include the universal MultyBag that turns into a practical shoulder bag, the FrontBag, a universal bag to "bring accessories and travel with the maximum comfort", and the X-Light Pack, a 255g ultra-light backpack; www.amphibious.it

ERMAX: New products from the French manufacturer include nose-screen designs for models such as the Yamaha NMax, TMax and Kymco Downtown 125, all available in a choice of colours and graphics, and as stock replacements, or offering higher rider protection; www.ermax.fr

SW-MOTECH: New products from the German luggage and accessory specialist include their new 'Legend' line of retro inspired luggage, their new 'Rearbag' and new 'Blaze' 28/42 litre capacity panniers made in 1680 denier Ballistic-nylon with internal stiffening and waterproof inner bags; www.sw-motech.com

AXO: Latest news is of the addition of limited edition Tony Cairoli gear sets to their 2016 line-up. The eight-time motocross world champion was involved in designing these variations of their 'Motion gear' jersey and pants line - this is AXO’s second phase of a four-release programme of new 2016 gear in order to sustain brand momentum and interest; www.axosport.com

ROOF: New for 2016 from the French helmet specialist, their 'Desmo' modular helmet features "automatic visor control" by an exclusive and patented desmodromic mechanism, venturi air-vents and new "silent lining" with air channels and visor sealing using three patented sealing techniques; www.roof.fr

Motoweek presents a selection of "Milan Show" exhibitor and product news. In a year that saw long-delayed R&D investments finally result in a tsunami of new product initiatives, exhibitors capitalised on the positive business environment and strong international industry visitor attendance seen this year ...

BREMBO: The company reported +15.6 percent growth in global sales revenues across the group for the nine months to September 2015; the motorcycle market is 9.7 percent of Brembo's total sales revenue and was +10.6 percent for the first nine months of 2015; www.brembo.com

AMPHIBIOUS: Six new products launched at EICMA include the universal MultyBag that turns into a practical shoulder bag, the FrontBag, a universal bag to "bring accessories and travel with the maximum comfort", and the X-Light Pack, a 255g ultra-light backpack; www.amphibious.it

ERMAX: New products from the French manufacturer include nose-screen designs for models such as the Yamaha NMax, TMax and Kymco Downtown 125, all available in a choice of colours and graphics, and as stock replacements, or offering higher rider protection; www.ermax.fr

SW-MOTECH: New products from the German luggage and accessory specialist include their new 'Legend' line of retro inspired luggage, their new 'Rearbag' and new 'Blaze' 28/42 litre capacity panniers made in 1680 denier Ballistic-nylon with internal stiffening and waterproof inner bags; www.sw-motech.com

AXO: Latest news is of the addition of limited edition Tony Cairoli gear sets to their 2016 line-up. The eight-time motocross world champion was involved in designing these variations of their 'Motion gear' jersey and pants line - this is AXO’s second phase of a four-release programme of new 2016 gear in order to sustain brand momentum and interest; www.axosport.com

ROOF: New for 2016 from the French helmet specialist, their 'Desmo' modular helmet features "automatic visor control" by an exclusive and patented desmodromic mechanism, venturi air-vents and new "silent lining" with air channels and visor sealing using three patented sealing techniques; www.roof.fr

Barnett Clutches & Cables

Clutch spring conversion kits - Yamaha

Barnett's US made coil spring conversion kits include a CNC precision machined billet aluminium pressure plate and six heavy duty coil springs to replace the stock diaphragm spring and pressure plate on select Yamaha models. These spring conversion kits are said to provide a more progressive, controllable clutch engagement compared to the OE diaphragm spring.

Multiple spring pressure options make them ideal for stock replacement and high performance applications. Installation is ‘bolt-on’ with no modifications required - it simply replaces the stock pressure plate/spring assembly. Barnett suggest that for maximum performance a set of Barnett clutch plates could be installed with the spring conversion kit.

The kits are available for the Yamaha V-Max (thru ’07), Royal Star, Road Star, XVS1100 V-Star, 1986-98 XV1100 Virago, FJ1100/1200, XJR1200/1300, FJR1300, XTZ12 Super Tenere, XV19 Raider/Roadliner/Stratoliner (thru 2012), YZFR1 (thru ’03), MT-01 and YXZ1000R SXS.

BARNETT CLUTCHES & CABLES

www.barnettclutches.com

Barnett's US made coil spring conversion kits include a CNC precision machined billet aluminium pressure plate and six heavy duty coil springs to replace the stock diaphragm spring and pressure plate on select Yamaha models. These spring conversion kits are said to provide a more progressive, controllable clutch engagement compared to the OE diaphragm spring.

Multiple spring pressure options make them ideal for stock replacement and high performance applications. Installation is ‘bolt-on’ with no modifications required - it simply replaces the stock pressure plate/spring assembly. Barnett suggest that for maximum performance a set of Barnett clutch plates could be installed with the spring conversion kit.

The kits are available for the Yamaha V-Max (thru ’07), Royal Star, Road Star, XVS1100 V-Star, 1986-98 XV1100 Virago, FJ1100/1200, XJR1200/1300, FJR1300, XTZ12 Super Tenere, XV19 Raider/Roadliner/Stratoliner (thru 2012), YZFR1 (thru ’03), MT-01 and YXZ1000R SXS.

BARNETT CLUTCHES & CABLES

www.barnettclutches.com

Germas

Reissa membrane 'Neo' jacket

Reissa membrane 'Neo' jacketThe short, versatile sporty looking three-quarters length 'Neo' jacket from Germas is made in nylon with wind/watertight and breathable REISSA membrane - a three-layer microporous membrane with a PU (polyurethane) coating and varying pore sizes. It has PU protectors at the elbows amd shoulders, Temperfoam back protection, reflective areas, 'AirVent' ventilation, multiple adjustment combinations and a flexible collar. GERMAS, Germany; www.germas.de

Subscribe to:

Comments (Atom)